From their internal design and appearance which is far from looking like the shelves and displays of regular supermarkets and hypermarkets, hard-discount stores were considered restricted to “the poor”. Mostly these are low-income households with children who visit such stores but with the global economic changes and the market developments, the clientele of hard-discount are getting more diversified.

Indeed, nowadays many middle-income households are also shopping at hard-discount stores because they are buying lots of basic goods, however, they still also shop in hypermarkets and supermarkets. This is actually what is called “zapping”, as consumers are unfaithful to products, brands and distribution channels. Thus, the hard discount stores have attracted an increasing population.

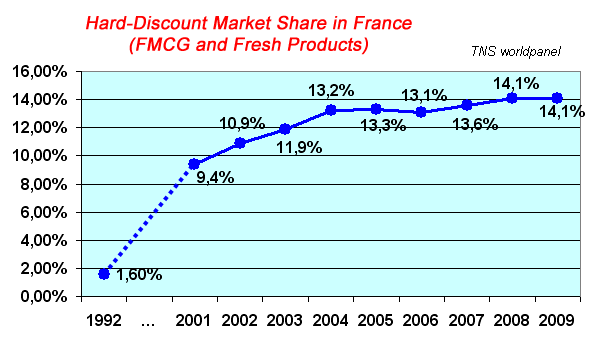

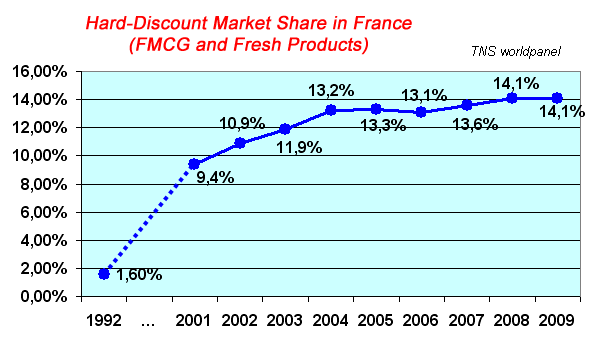

70% of households in France visit at least once a year a hard-discount (secodip), this represents 2 of 3 French households. Households are more and more attracted by “cheap stores” or the what-so-called “every day low prices”.

The hard-discount clientele can be divided into 4 categories:

The disappointed:

They attend more often hard-discount, as hypermarkets leave a very bad image in terms of price/quality. They also want to minimize the time spent doing their shopping, which is almost impossible in a hypermarket or supermarket. The average time spent in a hard-discount shop is 20 minutes, about 3 times less than in hypermarkets.

The hedonist:

This category takes pleasure while shopping and choosing products, which is why they occasionally visit hard-discounters because they are attracted by the promotions and the original products. But this does not prevent them from attending other store formats.

Small budgets:

They regularly attend hard-discount stores because they seek the lowest price and they appreciate the speed of service at check-outs.

New brand seekers:

They attend only occasionally hard-discounters because they are seduced by the unknown brands and their quality products. As a result, they do their main shopping in supermarkets and hypermarkets.

No matter in which of the above categories the consumer falls, the 3 essential points in a hard-discount store are: low prices, speed of service and proximity. Hard-discounters also understood a very important aspect of daily shopping need of their consumers, which is “quality” and this is getting more obvious during their negotiations.

No matter in which of the above categories the consumer falls, the 3 essential points in a hard-discount store are: low prices, speed of service and proximity. Hard-discounters also understood a very important aspect of daily shopping need of their consumers, which is “quality” and this is getting more obvious during their negotiations.

It is almost impossible to create a standard profile for consumers and their shopping behavior, as each one of them creates his own shopping pattern based on the different distribution formats he has access to and depending on his needs.

Products which have a quick turnover, and relatively low cost are known as Fast Moving Consumer Goods (FMCG). Examples of FMCG generally include a wide range of frequently purchased consumer products such as toiletries, soap, cosmetics, tooth cleaning products, shaving products and detergents, as well as other non-durables such as glassware, bulbs, batteries, paper products, and plastic goods. FMCG may also include pharmaceuticals, consumer electronics, packaged food products, soft drinks, tissue paper, and chocolate bars.

Products which have a quick turnover, and relatively low cost are known as Fast Moving Consumer Goods (FMCG). Examples of FMCG generally include a wide range of frequently purchased consumer products such as toiletries, soap, cosmetics, tooth cleaning products, shaving products and detergents, as well as other non-durables such as glassware, bulbs, batteries, paper products, and plastic goods. FMCG may also include pharmaceuticals, consumer electronics, packaged food products, soft drinks, tissue paper, and chocolate bars.

Tesco has unveiled plans to become a global brand owner, kicking off the strategy this month with the launch of non-Tesco-branded ice-cream and pet-food ranges.

Tesco has unveiled plans to become a global brand owner, kicking off the strategy this month with the launch of non-Tesco-branded ice-cream and pet-food ranges.

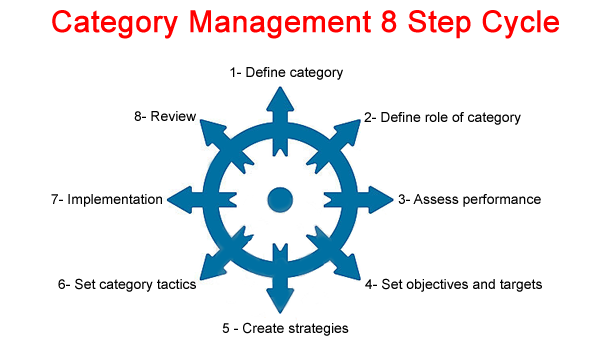

All consumer markets of industrialized countries and now developing countries are characterized by great diversity of supply and an increasing complication in the process of products assortments by retailers. This major increase in the number of products on the shelves, which may also interfere in some cases with the store offer but also in the shopping process of consumers, has led the retailers to consider setting up a new approach to their assortment and relying on a more active collaboration with the suppliers.

All consumer markets of industrialized countries and now developing countries are characterized by great diversity of supply and an increasing complication in the process of products assortments by retailers. This major increase in the number of products on the shelves, which may also interfere in some cases with the store offer but also in the shopping process of consumers, has led the retailers to consider setting up a new approach to their assortment and relying on a more active collaboration with the suppliers.

No matter in which of the above categories the consumer falls, the 3 essential points in a hard-discount store are: low prices, speed of service and proximity. Hard-discounters also understood a very important aspect of daily shopping need of their consumers, which is “quality” and this is getting more obvious during their negotiations.

No matter in which of the above categories the consumer falls, the 3 essential points in a hard-discount store are: low prices, speed of service and proximity. Hard-discounters also understood a very important aspect of daily shopping need of their consumers, which is “quality” and this is getting more obvious during their negotiations. The news is out, yesterday

The news is out, yesterday

The Shelf, home of brands and products, the oxygen of sales, those few centimeters from which products get their extreme mojo, brands their loyalty from millions of daily consumers and find their way into their shopping carts and it is these shelves that allows companies and brand owners to grow their businesses and increase their margins and profitability.

The Shelf, home of brands and products, the oxygen of sales, those few centimeters from which products get their extreme mojo, brands their loyalty from millions of daily consumers and find their way into their shopping carts and it is these shelves that allows companies and brand owners to grow their businesses and increase their margins and profitability.