Group buying was one of the interesting panels that took place at ArabNet Shift Digital Summit on 23rd of March, and it was moderated by Alexander McNabb.

Group buying was one of the interesting panels that took place at ArabNet Shift Digital Summit on 23rd of March, and it was moderated by Alexander McNabb.

The panelists where Sohrab Jahanbani from Gonabit, Sinan Khatib from BuyWithMe, Paul Kenny from Cobone, Brendan Ogilvy from Effective Measure, and an Egyptian guy from a group buying company located in Cairo, but i am really sorry for not remembering nor his name, neither his company name (help needed). Unfortunately the Groupon people did not show up at the summit, if someone knows the reason, please share it with us.

There was a rumor going around, that Groupon will show up at the ArabNet and announce their acquisition for a local group buying company, well, it seems that this will stay a rumor.

Alexander mentioned during the panel that there are around 25 group buying companies serving the region (Middle East and North Africa), and this number looked very BIG to me, after hearing many panels describing the e-commerce situation in this same region unless these group buying sites will start promoting their offers offline in order to attract potential future clients.

Alexander McNabb | Group Account Director, SpotOnPR

Alexander McNabb | Group Account Director, SpotOnPR

Alex has worked with IT, media and communications in the ME for over 24 years. He has developed marketing strategies and communications programs for leading global brands, done consulting work with Arab governments, and built strategies and managed national and regional communications campaigns.

It takes lots of time and efforts to find the appropriate services to satisfy the deal seekers, and sometimes it is very hard to convince the businesses to participate in such promotions.

Yesterday evening I was having a discussion with my wife and I mentioned to her about these group buying sites popping up everyday that she should check, maybe she might be interested in something, knowing that she is not an online buyer, actually she never bought anything online but I wanted to check on her reaction once she visits the sites. And just for the record, she said that Gonabit sounded the easiest name to remember.

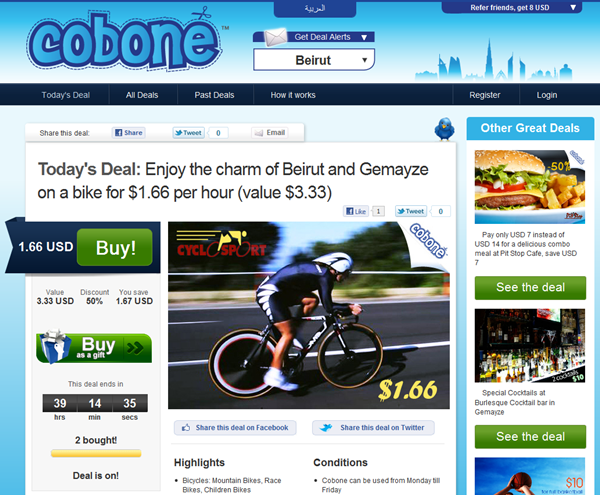

Personally I am a heavy online buyer, but never from group buying sites, so this morning, I have decided to check these sites to see what offers they are running and the first 2 sites I visited were Gonabit.com and Cobone.com and I was shocked !!!

Last week, during ArabNet, I had a side discussion with a friend, who was and is monitoring the group buying business in the region, so he summed up his point of view about this phenomenon, saying: “this is not a profitable business”, of course he backed up his argument with some simple figures to defend his case.

And my morning surprise made me totally understand my friend’s point of view more after seeing the available offers on both sites and this, from a business perspective.

Cobone is offering a bike ride in Beirut for $1.66-, so let us say the deal is on, and they sell 10 deals, or 20 deals or even 100 deals, the total cash out of this operation is $166.00- and let us also say the split is 50/50 between the site and the shop, so each one gets $83.00- >IF< 100 deals are sold.

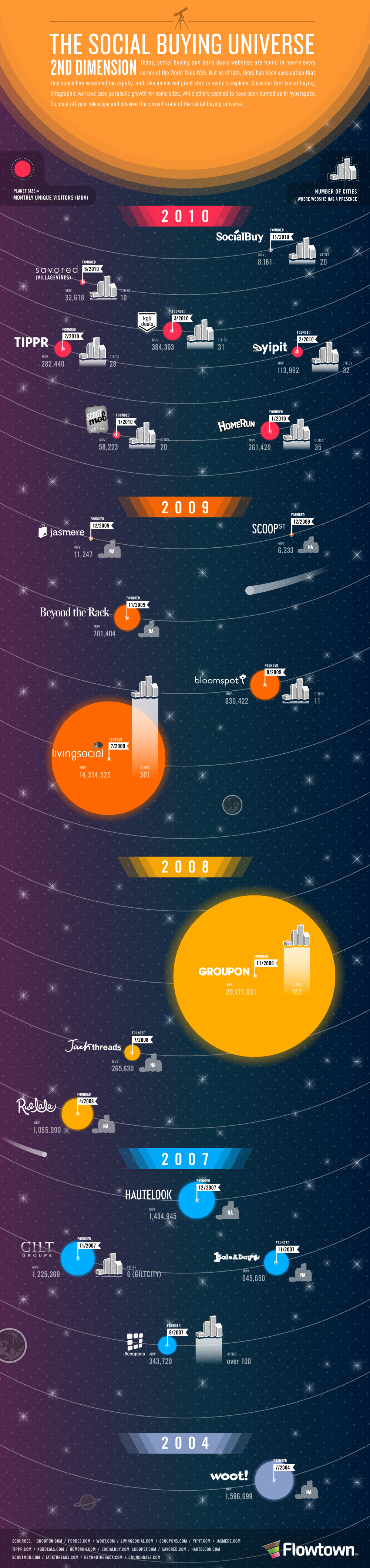

Same exercise for Gonabit who is offering an online live footbal game for $7.50-.

(By the time I was writing this post, around midnight, Cobone had 12 deals sold and Gonabit just 1).

From this simple calculation, I am trying to understand how these site will get profitable on the long run with their operational cost and how they will manage to cover these costs.

Is this the investors money that is getting burned?

Or maybe we are observing a new internet bubble like the one we had in 2000 and for those who don’t remember how things went bad in the US, few examples to refresh your memory, Boo.com spent $188 million in just 6 months in attempt to create a global fashion store. Pets.com raised $82.5 million in an IPO only to go bankrupt nine months later.

The biggest dot-com company that crashed and burned was WebVan. The company aimed to deliver groceries to homes and businesses. It raised $375 million in an IPO. WebVan forgot that it was actually in the grocery business, which has razor thin margins to begin with. In a mere 18 months the company had spent itself to bankruptcy.

If someone from the group buying industry is reading this blog post, I appreciate explaining your business model, so we can get it, again from business and profitability perspective, and hoping you are not sitting in HermanMiller Aeron Chairs.

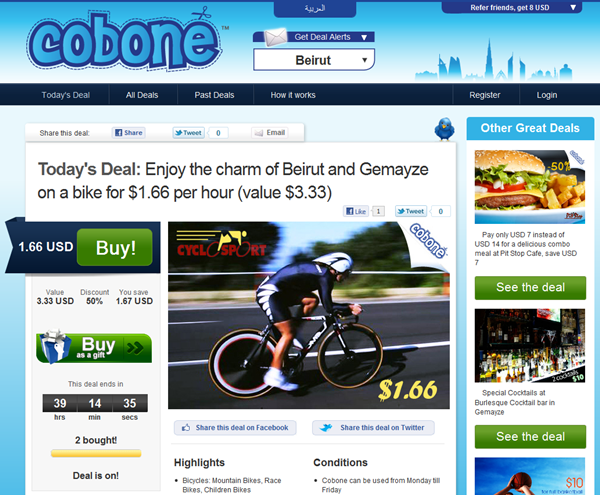

The global recession that started back in 2008 is still on and things does not look bright to many economies worldwide, an endless roller-coaster ride from the US to Europe does not seem to slow down anytime soon. Meanwhile a new online phenomenon developed and later on was known as “

The global recession that started back in 2008 is still on and things does not look bright to many economies worldwide, an endless roller-coaster ride from the US to Europe does not seem to slow down anytime soon. Meanwhile a new online phenomenon developed and later on was known as “

The news is out, yesterday

The news is out, yesterday

Yesterday, I found a new player from my twitter timeline, called

Yesterday, I found a new player from my twitter timeline, called  Group buying was one of the interesting panels that took place at

Group buying was one of the interesting panels that took place at  Alexander McNabb | Group Account Director,

Alexander McNabb | Group Account Director,