Coop Delists P&G Products

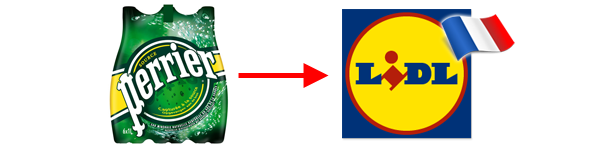

![]() Coop, the Swiss retailer, has announced that it is withdrawing 35 new products by Procter & Gamble from its shelves. Coop the second biggest retailer in Switzerland, was unable to agree a price decrease with the US multinational for the products. P&G refused to lower its prices and rising commodity prices in recent months was the reason given to the Basel group for the decision.

Coop, the Swiss retailer, has announced that it is withdrawing 35 new products by Procter & Gamble from its shelves. Coop the second biggest retailer in Switzerland, was unable to agree a price decrease with the US multinational for the products. P&G refused to lower its prices and rising commodity prices in recent months was the reason given to the Basel group for the decision.

Coop has temporarily withdrawn Lenor, Wella, and Antikal products from its stores; other P&G brands such as Gillette and Pampers will remain on the shelves.

Last month, Coop de-listed 95 items by foreign manufacturers due to the massive price increases brought about the strong Swiss franc. The retailer has reached agreement on most of these products and returned 56 items to its shelves.

Source: European Private Label Magazine

Coca-Cola went viral on more time. If you live in Australia, then you can buy Coke bottles with your name on it.

Coca-Cola went viral on more time. If you live in Australia, then you can buy Coke bottles with your name on it.

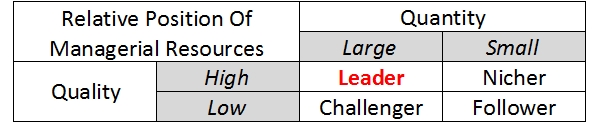

Product or Brand positioning is what comes to mind when your target market thinks about your product/brand compared to your competitor’s products/brands.

Product or Brand positioning is what comes to mind when your target market thinks about your product/brand compared to your competitor’s products/brands.

Multinationals never stop fighting counterfeited products and the bad guys never stop doing it. This game has been going on since forever and it seems gonna be here forever.

Multinationals never stop fighting counterfeited products and the bad guys never stop doing it. This game has been going on since forever and it seems gonna be here forever.