Rio Mare Boat

A pan-European Snickers 5+1 Promotion

US shoppers buy value-added (jumbo) packs and are used to the concept of buying in big quantities (maybe not all of them), without taking into consideration their daily consumption habits even in small families, but they understand the value of what they are getting and on the long run they are definitely cutting their average basket cost.

While warehouse club retailers like Costco, Sam’s Club or BJ’s Wholesale Club charge their clients a memberships cost anywhere from $50 to $100 a year and market the idea that shoppers can save more than the membership cost by shopping at these stores, consumers have different opinions: warehouse prices are not necessarily the best, the yearly fee is not always recouped and shopping at a warehouse is stressful.

In Europe, shoppers are not used much to warehouse clubs and it is not a very popular retail concept, except the Cash&Carry stores of Metro or Selgros targeting mainly the HORECA sector. But instead supermarkets and hypermarkets are offering more and more value added packs, but there are no clear figures about the shares of these Jumbo packs versus the regular ones, nor from the brand principles, neither from the stores, who are very discreet on their checkout figures.

In Lebanon, consumers are quite far from the shopping behavior of both US and EU and Jumbo packs are not very popular, except few brands/products and who while offering these packs are worried about the shelf take-off and think if the shoppers want to buy them, because nobody wants to carry a 10kg washing powder bag.

On-pack promotion for Cat Lovers, Whiskas is offering 300g on their 2kg packs for your lovely cats.

I’ve been traveling from the Middle East to the Gulf and North Africa and all over Europe for my daytime job which includes market visits and stores check of almost every known and unknown chain of supermarkets, hypermarkets and hard-discounters and all of these stores agree on a specific concept of in-store promotions and their neat presentation to attract traffic and initiate consumers take-offs.

During all these trips, I’ve never seen a promotion presented the way a Lebanese supermarket did in the below picture, maybe we are witnessing a new in-store marketing strategy!

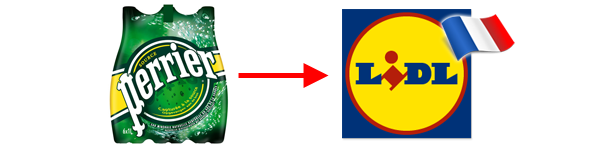

Nestlé Waters will be going through very hard times during their 2012 negotiations with major supermarket and hypermarket chains in France after listing one of their products in Lidl stores.

Lidl is one of the world’s major hard discounter and in continuous price war against the private labels of supermarkets and hypermarkets, by offering not-known brands to their shoppers. But in recent years, all major hard discounters started offering international brands on their shelves such as Nutella, Coca-Cola, Head&Shoulders and Nescafe and many others.

Lidl is selling Perrier PET 1l at a very attractive price of 0,64€ (3,84€ for pack of 6), while other major retailers are selling the same at an average price of 3,95€ in Auchan, 3,91€ in Système U, 3,88€ in Leclerc, 3,86 € in Carrefour and Intermarché.

Nestlé Waters had to calm down France No.1 retailer Carrefour by having a explosive promotion of “Buy 1 Get 1”.

Leclerc did wait long to follow on a “me-too” promotion on its private label, offered at 2,82€ the pack of 6x1l.

UAE development company Tameer Holding will develop the world’s largest LED screen to be embedded on an intended commercial tower in the Majan district of Dubailand, the company announced on Monday.

Termed ‘Podium’, the development will be a world first, boasting a 33-storey high LED media facade that will be visible from a distance of 1.5 kilometres.

The idea generated by Tameer has been designed by LED technology experts Dactronics and will be a powerful medium for advertising, messaging and art.