The Retailers Challenge = BIG Data

Retailers + Brands and Consumers + Shoppers = it’s love, maybe a 1-sided love affair, but it is there since forever.

Retailers and Brands cannot live in a world where consumers and shoppers do not exist, thus they need to take good care of them and fall in love with them every day and grow this love just to keep them coming their way because they are their only raison-d’être to open their stores every morning.

The retailers BIG Data should consider in the overall perspective:

_ Forecast & Replenishment Demand

_ Historical Purchases

_ Seasonality of Products and Events

_ Local & National Events

_ National and International Holidays

_ Strikes (if any)

_ Promotions & Their Effect

_ Weather Effect

Then in the more personalized part of the love affair with its clientèle:

_ The Store Location

_ The Neighborhood

_ Its Customers & Shoppers Profiles

_ The Surrounding Competition

_ Some Other Specifics

SMALL DATA by Martin Lindstrom

SMALL DATA by Martin Lindstrom

Hired by the world’s leading brands to find out what makes their customers tick, Martin Lindstrom spends three hundred nights a year overseas, closely observing people in their homes. His goal: to uncover their hidden desires and turn them into breakthrough products for the world’s leading brands. In a world besotted by the power of Big Data, he works like a modern-day Sherlock Holmes, accumulating small clues to help solve a stunningly diverse array of challenges. Lindstrom connects the dots in this globe-trotting narrative that will fascinate not only marketers and brand managers, but anyone interested in the infinite variations of human behavior.

Small Data combines armchair travel with forensic psychology into an interlocking series of international clue-gathering detective stories. It presents a rare behind-the-scenes look at what it takes to create global brands, and along the way, reveals surprising and counterintuitive truths about what connects us all as humans.

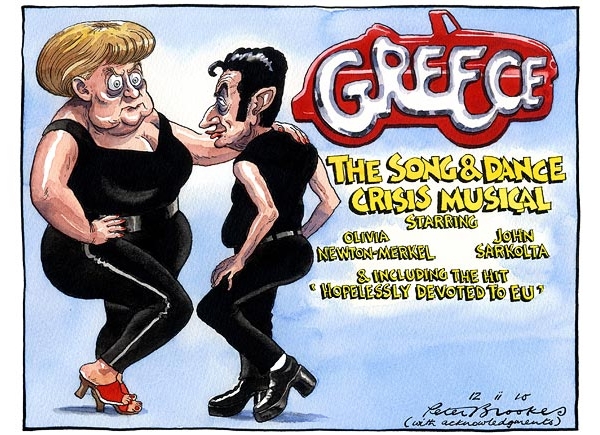

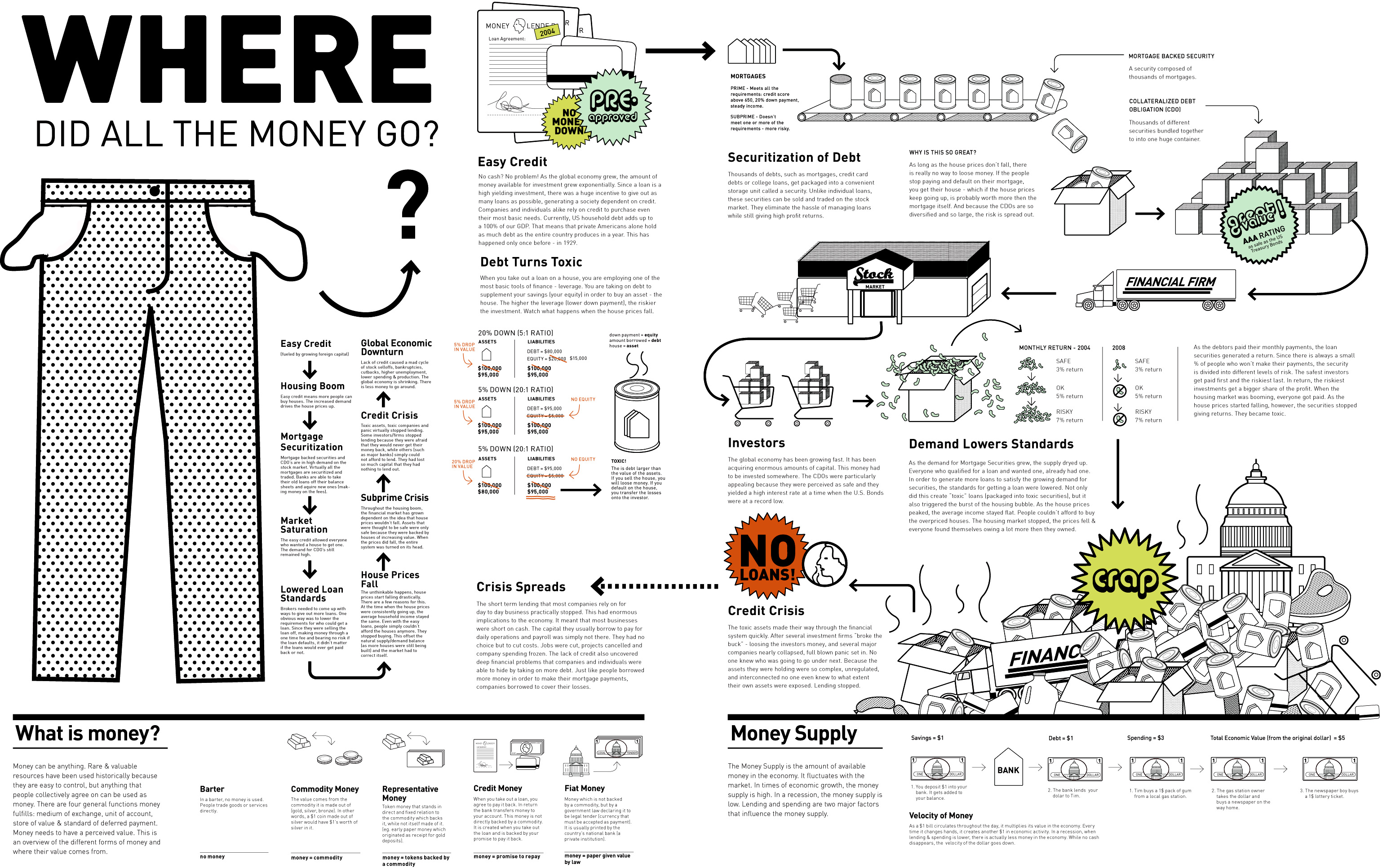

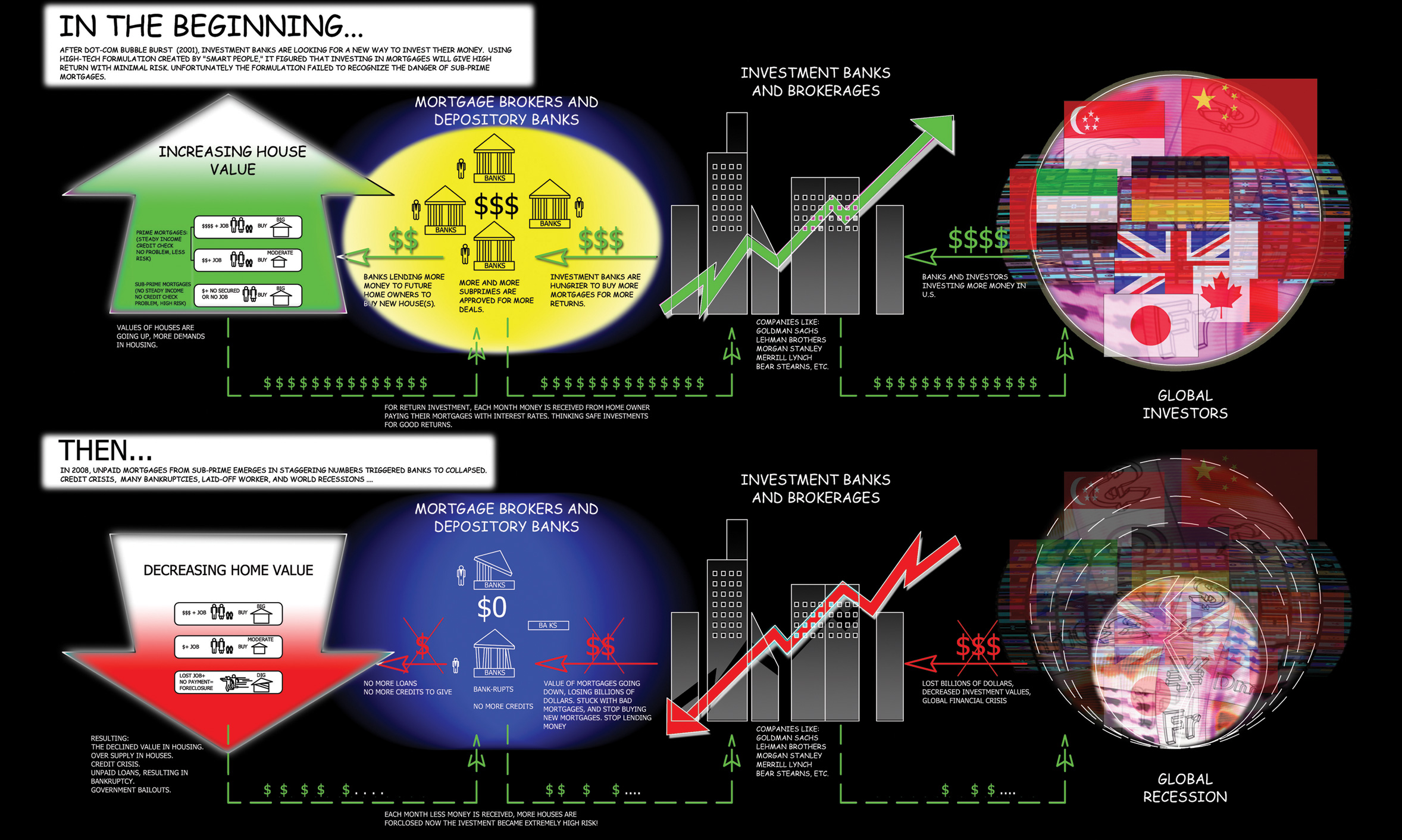

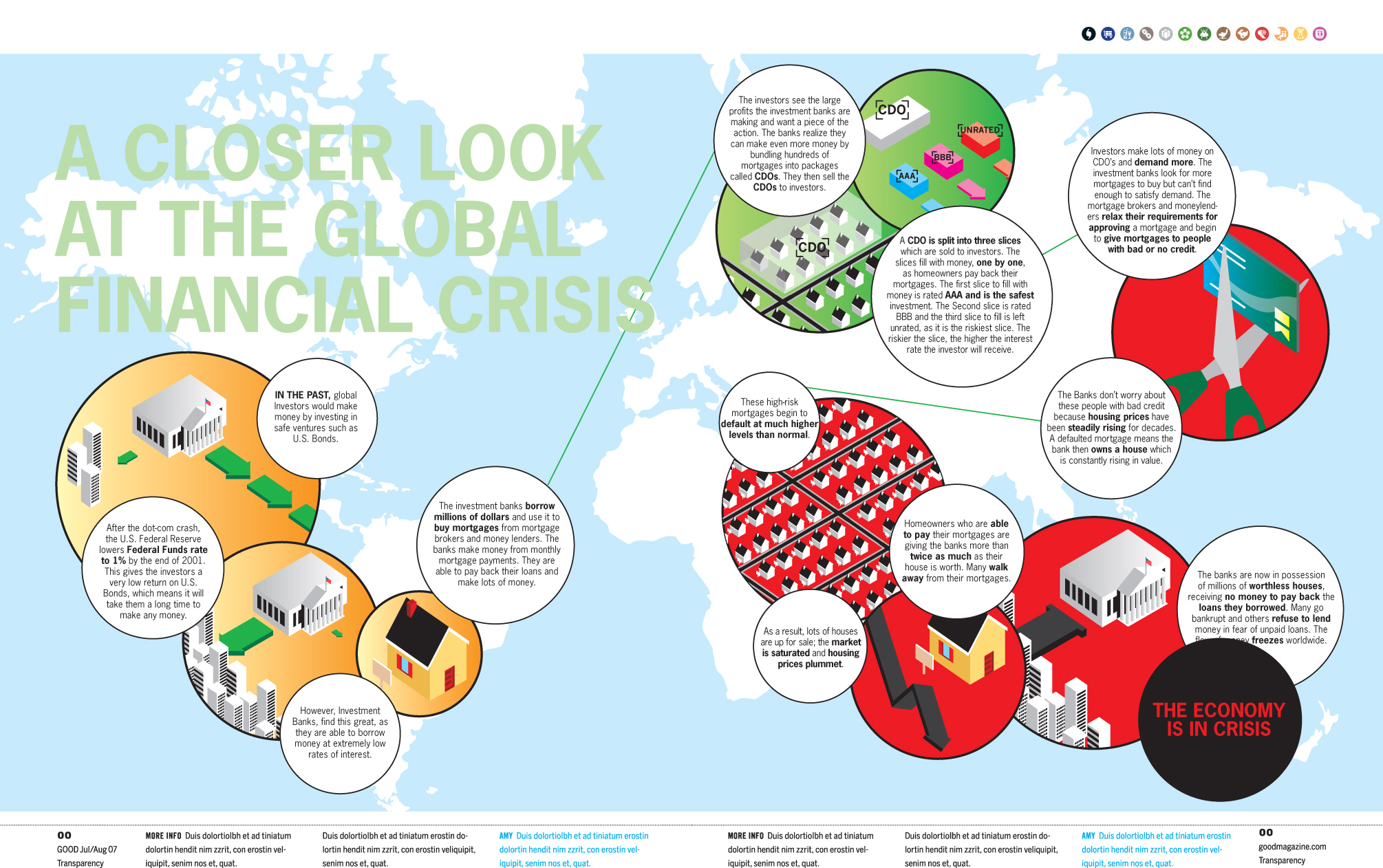

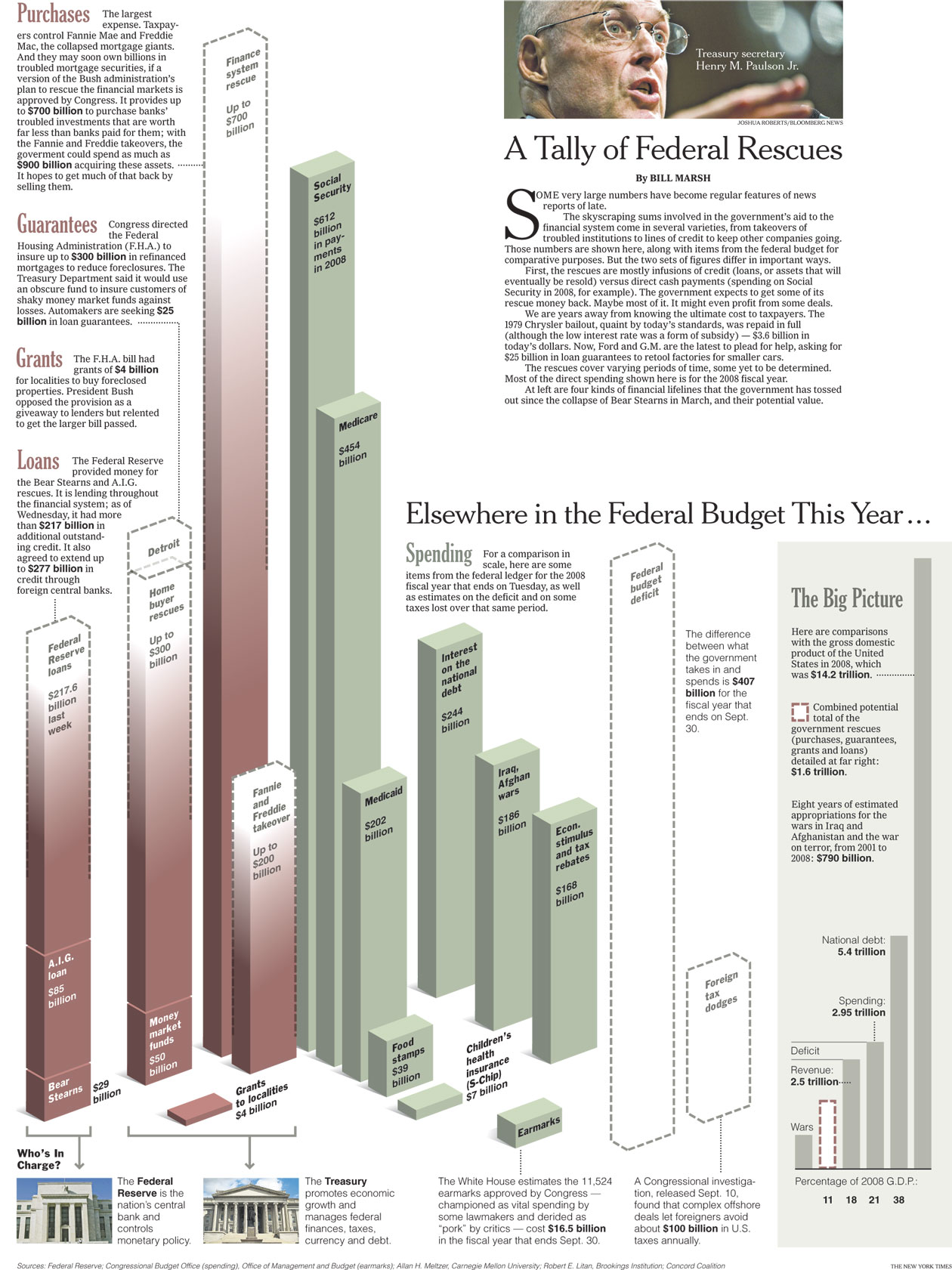

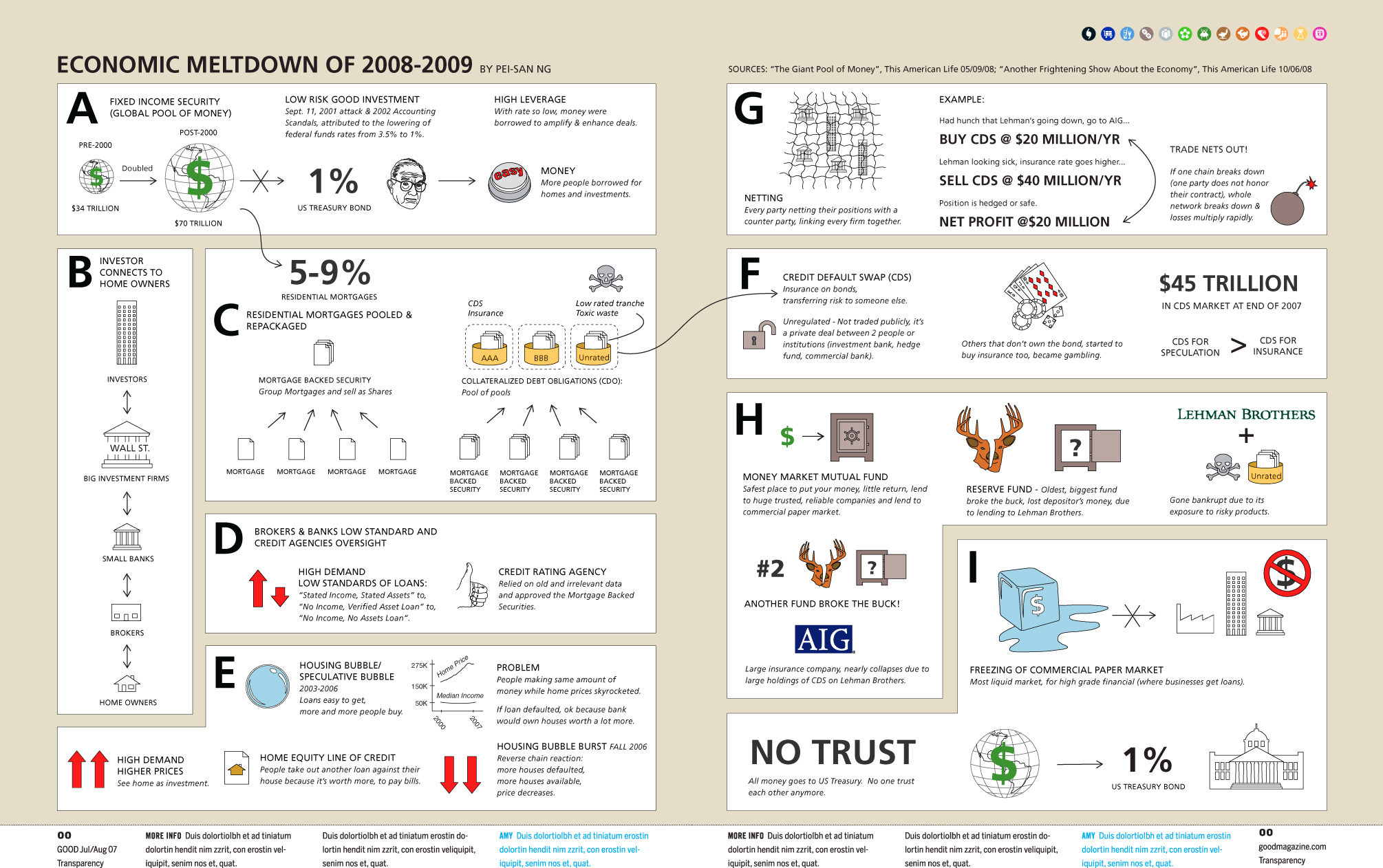

Cyprus, the beautiful Mediterranean island which is my all time favorite destination, for business and pleasure, is in deep trouble since 2 weeks. here is my opinion from a non-financial view and tryign to simplify it for the people who had no idea what is goign on in Cyprus.

Cyprus, the beautiful Mediterranean island which is my all time favorite destination, for business and pleasure, is in deep trouble since 2 weeks. here is my opinion from a non-financial view and tryign to simplify it for the people who had no idea what is goign on in Cyprus.

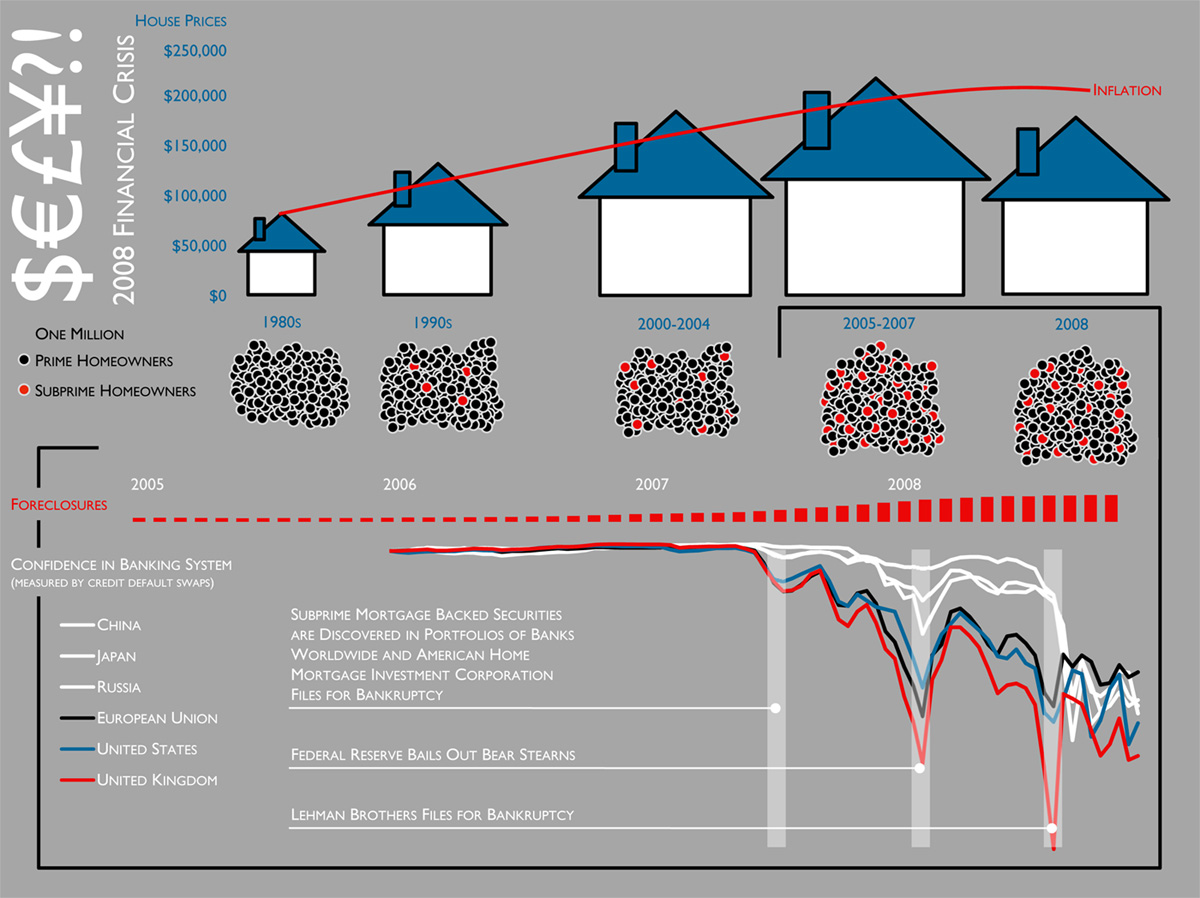

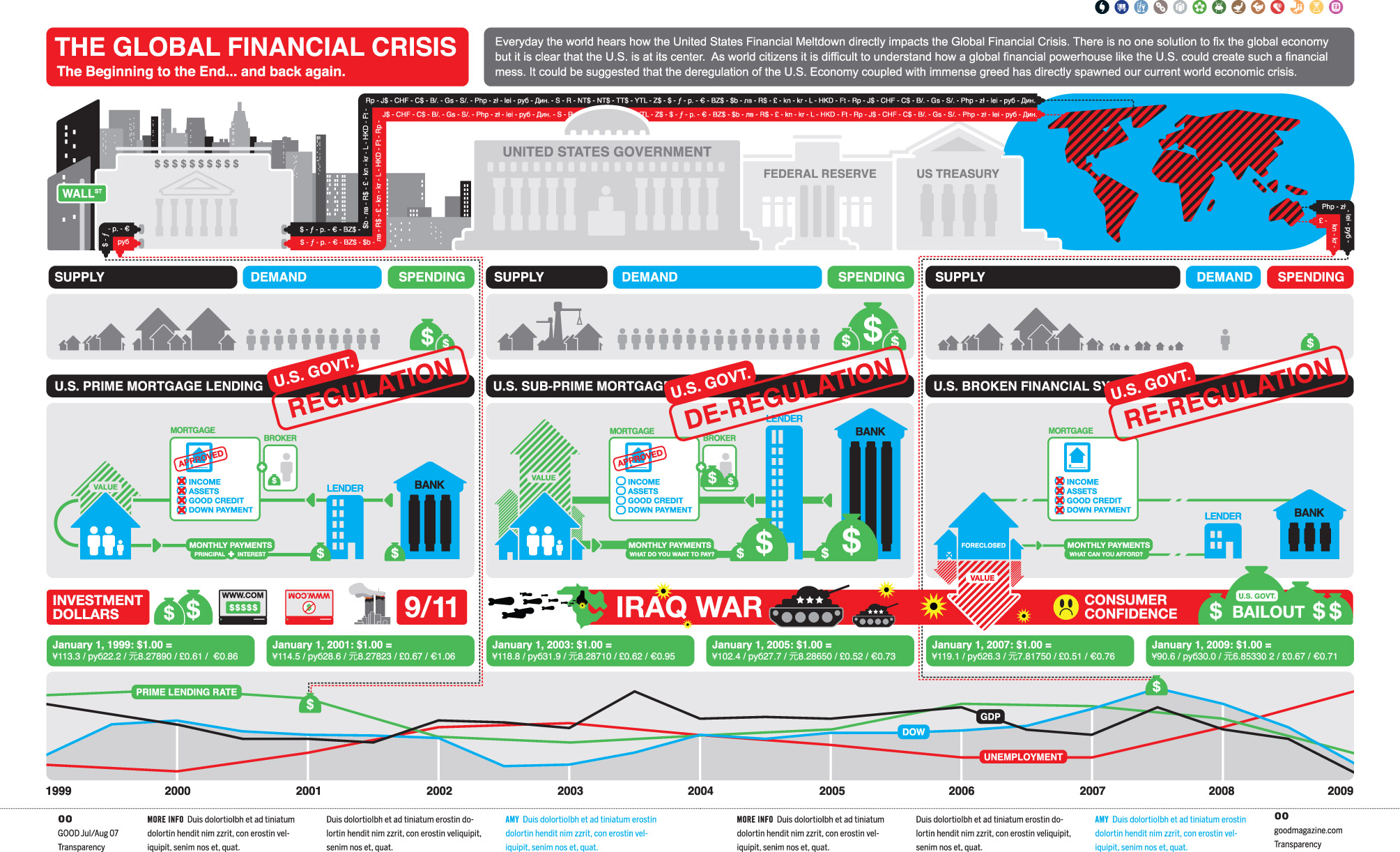

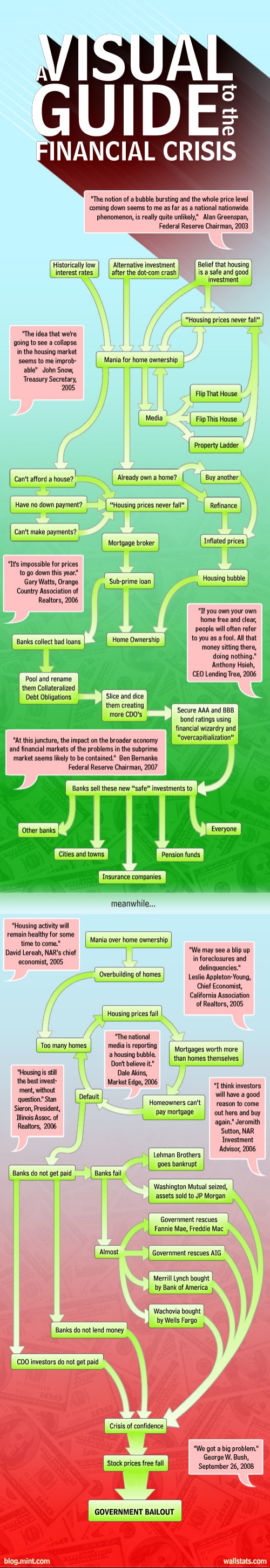

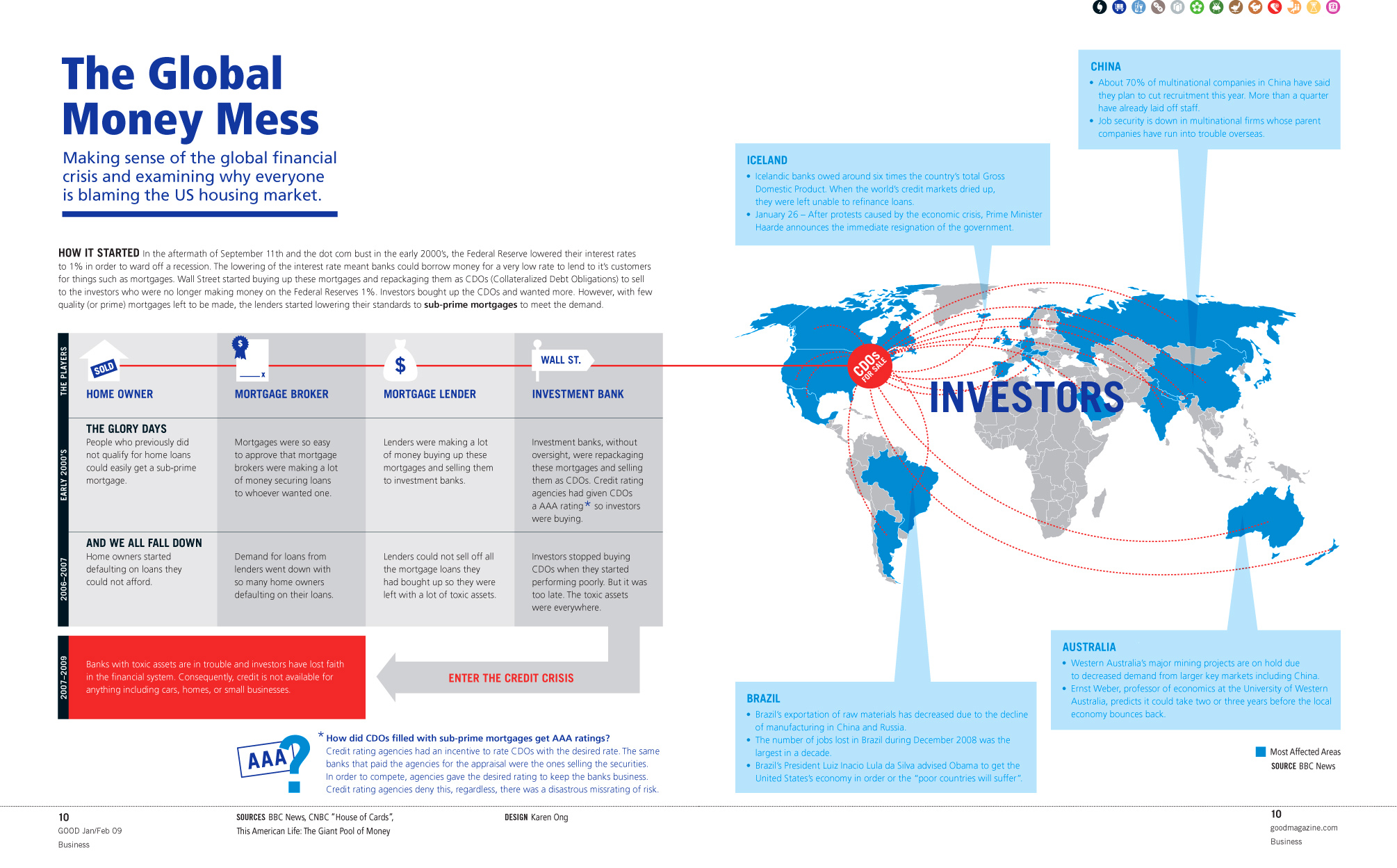

The global recession that started back in 2008 is still on and things does not look bright to many economies worldwide, an endless roller-coaster ride from the US to Europe does not seem to slow down anytime soon. Meanwhile a new online phenomenon developed and later on was known as “

The global recession that started back in 2008 is still on and things does not look bright to many economies worldwide, an endless roller-coaster ride from the US to Europe does not seem to slow down anytime soon. Meanwhile a new online phenomenon developed and later on was known as “

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=d70032fa-7281-46a0-997c-333af49ae4b1)