Category: Hypermarkets

Bad Experience @ TSC Mega / CityMall

Saturday afternoon I dropped by TSC Mega at CityMall but my experience that day was quite bad.

Saturday afternoon I dropped by TSC Mega at CityMall but my experience that day was quite bad.

When you enter the store, you look around for those blue or red plastic shopping basket which you don’t find then you decide to pick one of those trolleys which are not clean and struggle to push them as their wheels are not working properly.

Then I hit the non-food section to pick up what I came for, and there was the biggest surprise, very bad lighting, huge and long shelves almost empty showing those stocks of unsold products that gives you a feeling that the store is going bankrupt very very soon.

Of course you barely can spot someone from the staff to ask any question in any section (and most probably if you ask a question you won’t get the correct answer).

After getting the few small things in that huge trolley I had, direction check-out.

39 check-outs in the store and I guess not more than 7 were open on a weekend with a huge line at each check-out, even the check-out stating “10 items or less” was full with clients pushing trolleys full of stuff and more than 10 items and nobody from the staff cared about it (I had less than 10 items)

Then the cashier starting scanning my items, after the 1st item, he stopped and started arguing with the supervisor of the porters and totally forgot that I was standing there, then restarted the scanning process, I paid and left.

No wonder you hear on the market that TSC is going thru bad times and it looks so obvious after my visit.

Carrefour Planet

Carrefour has totally reinvented shopping for its customers, and the Carrefour planet concept offers them a new shopping experience centered around making purchases in comfort, friendliness and fun. The new stores boast a festive atmosphere of discovery, specialist offers organized into key areas, lower prices, brand new services and new technologies.

Carrefour has totally reinvented shopping for its customers, and the Carrefour planet concept offers them a new shopping experience centered around making purchases in comfort, friendliness and fun. The new stores boast a festive atmosphere of discovery, specialist offers organized into key areas, lower prices, brand new services and new technologies.

In a friendly and animated atmosphere, Carrefour planet has a range of products that has been completely rethought out and is better suited to the expectations of its customers, organized into key areas:

THE MARKET AREA, with a varied range of extremely fresh products, tastings held on a regular basis, cooking lessons, an expanded delicatessen area, freshly cut fruit and vegetables or sushi being prepared.

THE ORGANIC AREA, with a wide variety of Organic products, Carrefour brands as well as other specialist brands, tastings held on a regular basis and discounted prices so that everybody can enjoy organic products…

THE FROZEN FOOD AREA, with an extremely wide range of frozen products, reworked customer flows with an offering that is organized into different areas that follow the order of a traditional meal, closed freezers for greater comfort and cooking demonstrations.

THE BEAUTY AREA, in an environment that has been given a complete makeover for the well-being of its customers. They can purchase their beauty products at a leisurely pace and get expert advice, as well as enjoying services such as rapid make-up applications and express hairstyling. Among the other innovations is a virtual mirror which customers can use to test make-up products ‘live’ at interactive terminals.

THE FASHION AREA, which has been re-organized to include the whole world of fashion, showcase new collections and provide a new range of services, including free advice and alterations.

THE BABY AREA, which brings together everything new parents need under one roof, from food products to nappies, as well as pushchairs, clothing and furniture. Mothers are pampered and can enjoy access to a free birth list service and have their more bulky shopping carried for free, as well as benefit from the advice of a pediatric specialist.

THE HOUSE AREA, is split into 4 sections (“Kitchen and Table”, “Home Deco”, “Practical Home” and ”Home Accessories“), with a whole new selection and many color-coded ranges.

THE LEISURE – MULTIMEDIA AREA , brings together the Culture and multimedia areas, organized according to brand. All the latest technologies are showcased, including 3-D TV, touchscreen tablet computers and e-books. A whole new digital store has been created offering customers the opportunity to sign up for digital subscriptions and services, as well as a completely dedicated Apple area.

For certain categories, exclusive partnerships with major brands mean that customers can discover a new offer: for example, Virgin will have a wide selection of cultural products in the Vénissieux store, Réserves Naturelles will have its own dedicated area in the beauty world for make-up, accessories and costume jewelery.

Because the comfort of customers as they do their shopping is a priority for the new banner, specialist advisers will be available in each area to welcome and support customers as they make their choices.

Carrefour Planet stores have been implemented so far in France, Spain, Italy & Greece

What Value Can Groupon Add To Groceries?

The news is out, yesterday Groupon started partnering with a grocery chain to start a test program. But what value can this kind of partnership bring to groceries, supermarket and hypermarkets?

The news is out, yesterday Groupon started partnering with a grocery chain to start a test program. But what value can this kind of partnership bring to groceries, supermarket and hypermarkets?

In my opinion, it will not add any value.

Why? Because food retailers all over the world and in partnership with brands, are into the “group buying” business without declaring it with these words, way before Groupon and all the rest and without any minimum quantity restrictions.

Supermarkets and hypermarkets, on any given day, have an average of 100 promotions and discounted products on their shelves, websites, printed leaflets, …

Brand owners, depending on the category, fight every 7 or 14 days to find a free space in the catalog of a retailer and most of these leaflets are showing only promoted products, price discounted items, buy1get1, value packs, etc… the promotion formats can be endless as brand owners can be very creative to push their sales.

Not forgetting that also some food retailers, keep on always offering loyal consumers who are part of their loyalty programs, additional discounts and promotions, to make them feel more special.

No matter what kind of promotion format Groupon or other group buying sites will use or offer their consumers, but surely it going to be déjà vu, specially that some retailers also started showing a countdown clock for promotions on their websites.

Sweden Retail Market Scene

Sweden/Sverige, officially the Kingdom of Sweden , is a Nordic country on the Scandinavian Peninsula in Northern Europe. Sweden shares borders with Norway and Finland and is connected to Denmark by a bridge-tunnel across the Öresund.

At 450,295 square kilometres, Sweden is the third largest country in the European Union by area, with a total population of about 9.4 million. Sweden has a low population density of 21 inhabitants per square kilometer with the population mostly concentrated in the southern half of the country. About 85% of the population live in urban areas.Sweden’s capital is Stockholm, and with 1.3 million inhabitants, it is also Sweden’s largest city.

The retail scene of the Swedish market is a bit different from other European countries, mainly western ones, where big groups are controlling the mini/super/hyper daily game, while in Sweden, it’s the Swedish retail brands themselves who have full domination of their own field and so far no external player showed up except in the hard-discount format.

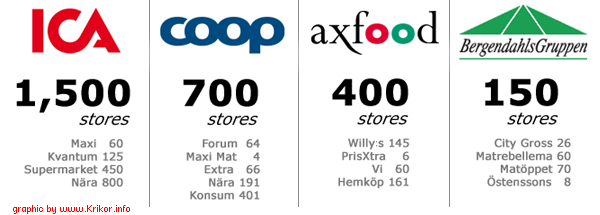

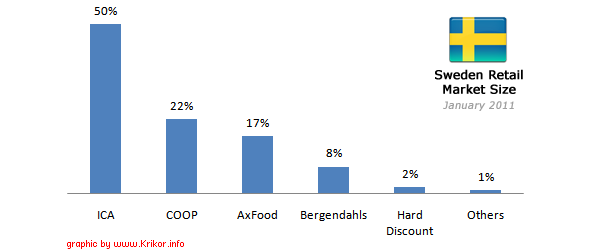

Swedish retail market is dominated by 4 local players who, together they manage 97% of the total market size: ICA, COOP, AxFood and Bergendahls.

The hard-discount format also exist, where Lidl (Germany) and Netto (Denmark) are simply enjoying 2% of the total market size and the last 1% are all the rest.

Another store category is working in the shadow silently, the ethnic stores, well organized in Sweden, but with limited dispersion in the populated areas of Stockholm and its suburbs, these stores are mostly owned by immigrants and their surface varies from 100 to 700 sqm.

![]()

Poland Hard-Discount Scene

The Polish retail scene is not much different from the rest of East and West European markets, but when it comes to the Hard-Discount sector, a major player is out there and trying to control it 100% against the other smaller players who are way behind Biedronka in this race.

Today Biedronka (the ladybug in Polish) owned by Portuguese Jeronimo Martins has more than 1,600 stores located both in large cities and small towns around Poland and regularly visited by 58% of Poles.

Today Biedronka (the ladybug in Polish) owned by Portuguese Jeronimo Martins has more than 1,600 stores located both in large cities and small towns around Poland and regularly visited by 58% of Poles.

Biedronka increased its sales by 29% in 2010. Such results placed the chain among the three largest Polish companies. According to Jeronimo Martins, Biedronka’s sales revenues for 2010 totaled around PLN 19.2bn (€4.81bn).

At present, the chain is comprised of 1,649 stores with an assortment of 900 products with 9 active distribution centers and 2 new DC coming in 2011.

In 2010, Biedronka opened 183 new stores and the plan for 2011 is 200 new stores and a total of 3,000 stores by the end of 2015.

The followers in this game are the Germans Lidl (380 stores) & Aldi (45 stores), the Danish Netto (200 stores) and soon to become discounter local chain PoloMarket (300 stores).

All 4 of them, are watching and monitoring Biedronka’s moves very closely but the latter is not even losing time looking around as they are busy being aggressive.

Plus the purchasing power that is now in the hands of Biedronka is not accessible by others, just imagine the pressure they put on suppliers and brand principles for a simple promotion operation in all their stores for a week or 10 days, let us say they will order an average of 3 cases of 1 product in 1650 stores, that is 4950 cases or around 60,000 units, so they can easily twist your elbow when it comes to price.

Retailers Against Suppliers

The war is going on between the retailers (supermarkets and hypermarkets) and the suppliers (brand principles) and if you are wondering why, it is because of the non-stop products price increase.

The war is going on between the retailers (supermarkets and hypermarkets) and the suppliers (brand principles) and if you are wondering why, it is because of the non-stop products price increase.

And no matter who will win at the end of the tunnel (it is a very very long tunnel), the biggest loser will be the consumer as both parties are trying to pass the new cost(s) to him.

Some retailers are categorically refusing the new rising costs while others are putting a limit for the increase by fixing a percentage (Leclerc in France limited it to 2%), and some (which I hardly believe) are cutting some points from their own margins to keep the prices aligned because they would like to maintain their status of EDLP (everyday low prices).

Definitely the biggest part of this pressure is on the suppliers because of the endless influence of retailers and the ability of buyers to say “NO” (sometimes no matter what you offer them).

Therefore some suppliers will follow a new tactical move and it is by decreasing the packaging size, which means offering less for the same price, leading to have a higher unit price and making it difficult to consumers to spot the difference and in my opinion this is not ethical.

Some brand principles have a different point of view, such as increasing prices and all the rest will follow but this is a risky step to take and needs some time to be reflected on the market and might take some consumers away from picking their products and some other principles might take advantage of this by waiting some time and giving the impression that their prices are stable and this might lead to some confusing on the consumer decision making while at the shelf.

During all this dilemma, the retailers are giving more hard time to suppliers by cutting down their assortments and removing under-performing products provided that this will not hurt the consumer basket, consequently this will help them optimize their shelves with products bringing more margins to their pockets.

We have also seen some extreme situations, where retailers delisted well known international brands, as example, Costco in the US removed Coca-Cola from its shelves for 3 weeks back in 2009 and in the UK, a Tesco and Premier Foods dispute for same reasons, led to the removal of 12-18 products from the shelves.

Before judging who is right or wrong, one thing is sure, the power continues to shift into the hands of the retailers, and this goes for every and each market and country.