Author: Krikor

Costco … in Lebanon!

We all know who Costco is, and for those who don’t, Costco is the 3rd largest retailer in the US and operating in other 7 countries (Canada, Mexico, United Kingdom, Japan, South Korea, Taiwan & Australia) and now in Lebanon!

OK, this is not true, because the store in question is a copycat, using a modified logo, even that the products are pure American and you can find them in a real Costco store.

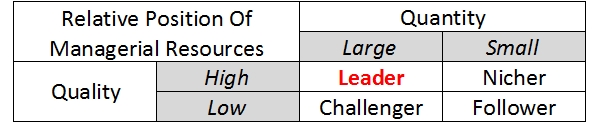

Leader, Challenger, Follower, Nicher

Product or Brand positioning is what comes to mind when your target market thinks about your product/brand compared to your competitor’s products/brands.

Product or Brand positioning is what comes to mind when your target market thinks about your product/brand compared to your competitor’s products/brands.

Having a competitive advantage is necessary for a firm to compete in the market. But what is more important is whether the competitive advantage is sustainable. A company must identify its position relative to the competition in the market. By knowing if it is a leader, challenger, follower or nicher, it can adopt appropriate strategies to compete.

Product positioning is a crucial ingredient in the buying process and should never be left to chance. It’s your opportunity to influence the market’s perception of your products.

Failure to proactively address product positioning is unlikely to end well. With or without your input, customers will position your product—probably based on information from your competitors, which will not flatter you.

Genre of Market Position

- Leader: Largest share

- Challenger: Medium share, to challenge the leader

- Follower: No offensive posture against the leader

- Nicher: Small market size, segmentation other firms cannot think of

Matrix of Market Position/Managerial Resources

– Quantitative managerial resources: number of sales force, input financial power, production

capacity, etc.

– Qualitative managerial resources: corporate/brand image, marketing power, technological power,

leadership of top management, etc.

Book recommendation: Positioning: The Battle for Your Mind

DM Private Label on Amazon.de

German discount drugstore DM (Drogerie Markt) started selling its private label products under the different DM-brands online on Amazon.de, the latter will take care of the sales and distribution.

The cooperation is expected to be mutually beneficial. For DM it will be interesting to test consumer interest for its personal care products on the internet without having to invest in online logistics itself.

In case it would appear that online sales of relatively low-priced private labels will be a profitable business model, DM could decide to open its own web store.

Group Buying & Global Recession

The global recession that started back in 2008 is still on and things does not look bright to many economies worldwide, an endless roller-coaster ride from the US to Europe does not seem to slow down anytime soon. Meanwhile a new online phenomenon developed and later on was known as “group buying“.

The global recession that started back in 2008 is still on and things does not look bright to many economies worldwide, an endless roller-coaster ride from the US to Europe does not seem to slow down anytime soon. Meanwhile a new online phenomenon developed and later on was known as “group buying“.

Was the “questionable” success and business model of group buying sites built at the expense of the recession and consumers who are spending less every day and are trying to cut on their average basket?

Before consumers can resume spending as in their previous lives, many of them must reset their balance sheets. How can US consumers keep spending when are they consumed by the economic pressures and it will take an average of 30 years to payoff what they owe on credit cards?

What if the global economy recovers, will these group buying sites be doomed?

Already lots of consumers entered the daily deals fatigue mode and it doesn’t always work for retailers and businesses financially?

Lately 2 major players went out of deals, Facebook and Yelp left the battle field and Groupon, the biggest player is experiencing a 50% traffic decline.

The recession also pushed a new type of business for the food and restaurants industry and its first players started to appear and this phenomena is called Social Dinner, Group Dining or Social Meals.

Grub With Us is already up and running and Social Dine is launching soon.

On a separate note, a monthly survey, conducted by IGD, has found that 29% of consumers in the UK are planning to switch their food shopping from their usual supermarket to hard-discounters, in a bid to cut down on their shopping bills in the middle of escalating inflation.

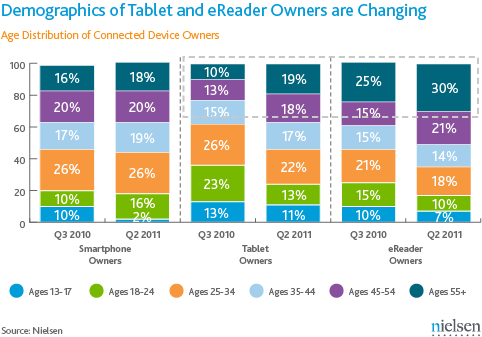

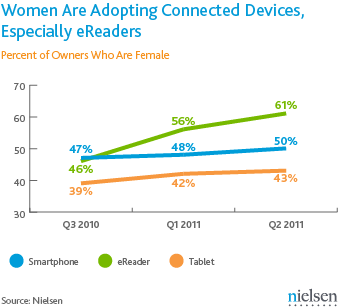

Ladies Love e-Readers; Guys Prefer Tablets

According to Nielsen’s second-quarter survey in the US, 61 percent of e-reader owners are women, up from 46 percent in the third quarter of last year. Meanwhile, men make up 57 percent of tablet owners, which is down from 61 percent in the third quarter. Smartphones are used equally by women and men.

Convenience Retailing in Japan

Japan is the largest market in the world for convenience stores, accounting for 37% of total global sales, states Raphael Moreau, Retailing Analyst at Euromonitor International. Japanese convenience stores are known for their innovation, product assortments and varied store concepts.

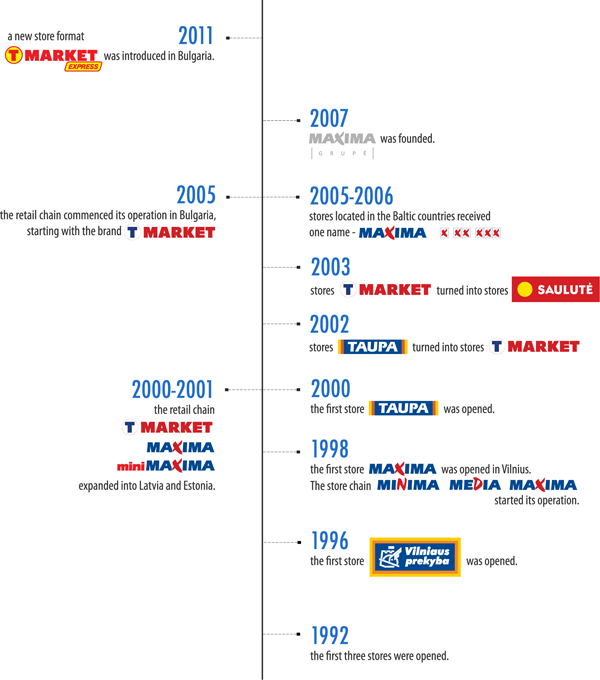

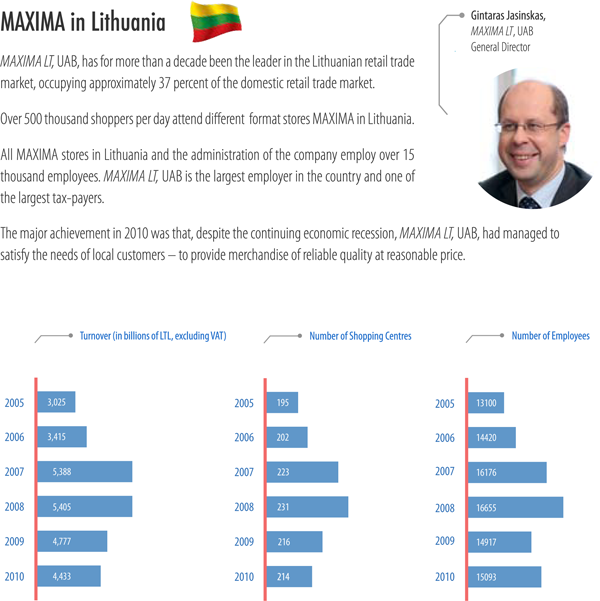

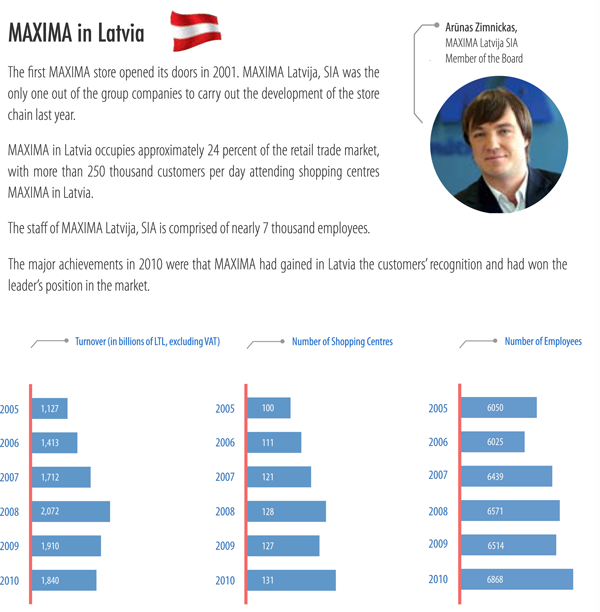

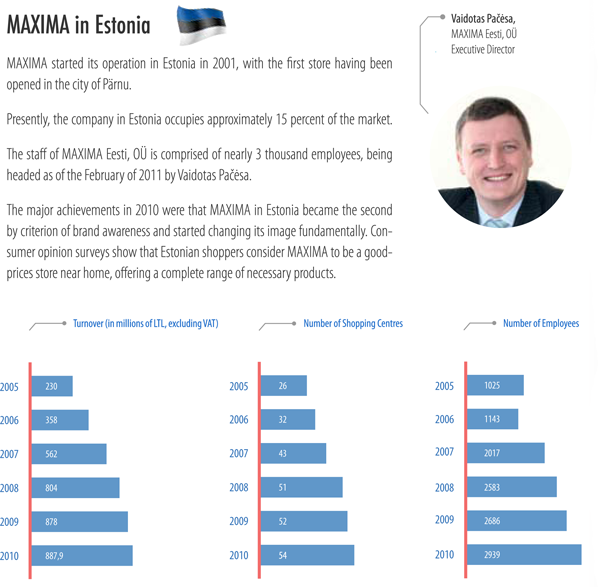

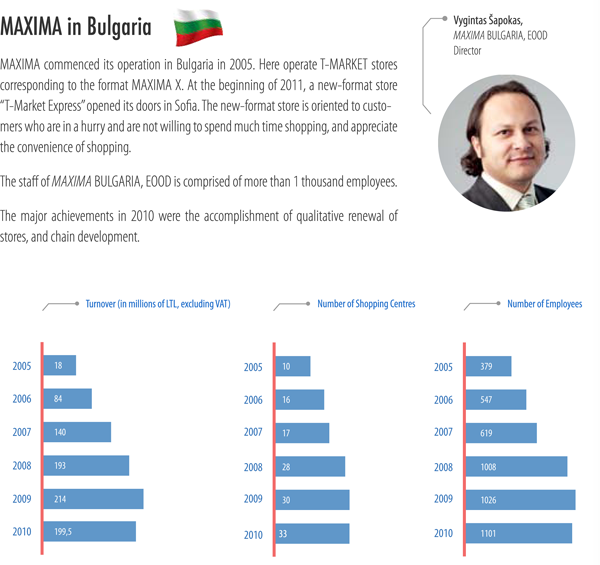

MAXIMA – Biggest Baltic Retailer

MAXIMA is a retail chain operating in Lithuania, Latvia, Estonia, and Bulgaria and is the largest Lithuanian capital company and the largest employer in the Baltic States.