12 Steps to New Product Success

At its Consumer 360 conference in Orlando, Fla., on June 22, New York-based Nielsen unveiled an approach that could greatly improve the chance of a new product’s success. Based on tracking 600 product launches and testing 20,000 initiatives, the approach could raise the chance of succeeding in the marketplace from 10 percent to 75 percent.

At its Consumer 360 conference in Orlando, Fla., on June 22, New York-based Nielsen unveiled an approach that could greatly improve the chance of a new product’s success. Based on tracking 600 product launches and testing 20,000 initiatives, the approach could raise the chance of succeeding in the marketplace from 10 percent to 75 percent.

“By identifying key criteria every successful new product must meet, we’re helping marketers know where to focus their efforts in new product development and in-market execution,” said Vicki Gardner, senior vice president, product innovation North America, Nielsen. “As a result, companies gain a huge leap forward with more actionable advice and better decision-making, and that means better investment of new-product marketing dollars.”

Nielsen’s criteria — which encompass five main areas — are:

Salience

1. Does the product offer a true innovation?

2. Will the product be noticed?

Communication

3. Is your message conveyed in a simple, persuasive way?

4. Do you have a clear and concise message? Is it conveyed without clutter?

Attraction

5. Does your product have a substantial need/desire? Is it solving a problem or meeting consumers’ needs?

6. What is your product’s advantage? Is it better than others currently in the marketplace?

7. Are your product claims believable?

8. Are there acceptable downsides? (These are typically related to side effects for over-the-counter products.)

Point of Purchase

9. Is the product where consumers expect it to be? Can shoppers find it easily among the competition?

10. What are the cost/benefit tradeoffs at the shelf (price, calorie content, usage instructions, etc.)?

Endurance

11. Did you meet or exceed consumers’ expectations? Are you delivering on your product’s promise?

12. Will consumers continue to purchase your product in the future?

The Shelf, home of brands and products, the oxygen of sales, those few centimeters from which products get their extreme mojo, brands their loyalty from millions of daily consumers and find their way into their shopping carts and it is these shelves that allows companies and brand owners to grow their businesses and increase their margins and profitability.

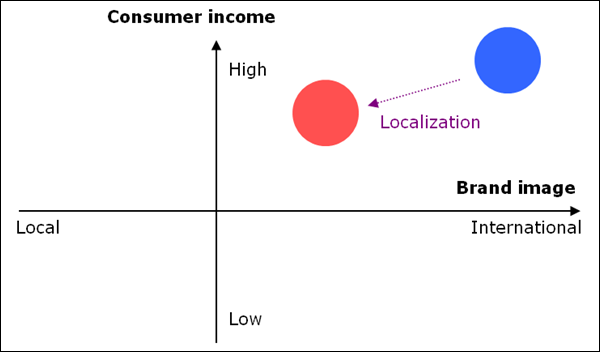

The Shelf, home of brands and products, the oxygen of sales, those few centimeters from which products get their extreme mojo, brands their loyalty from millions of daily consumers and find their way into their shopping carts and it is these shelves that allows companies and brand owners to grow their businesses and increase their margins and profitability. The globalization of the world economy has triggered more and more companies to expand beyond their local markets. This is especially true for brands that already enjoy a good reputation in their country’s market.

The globalization of the world economy has triggered more and more companies to expand beyond their local markets. This is especially true for brands that already enjoy a good reputation in their country’s market.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=b0950cf7-0776-47b0-ac2f-7e5726a66703)