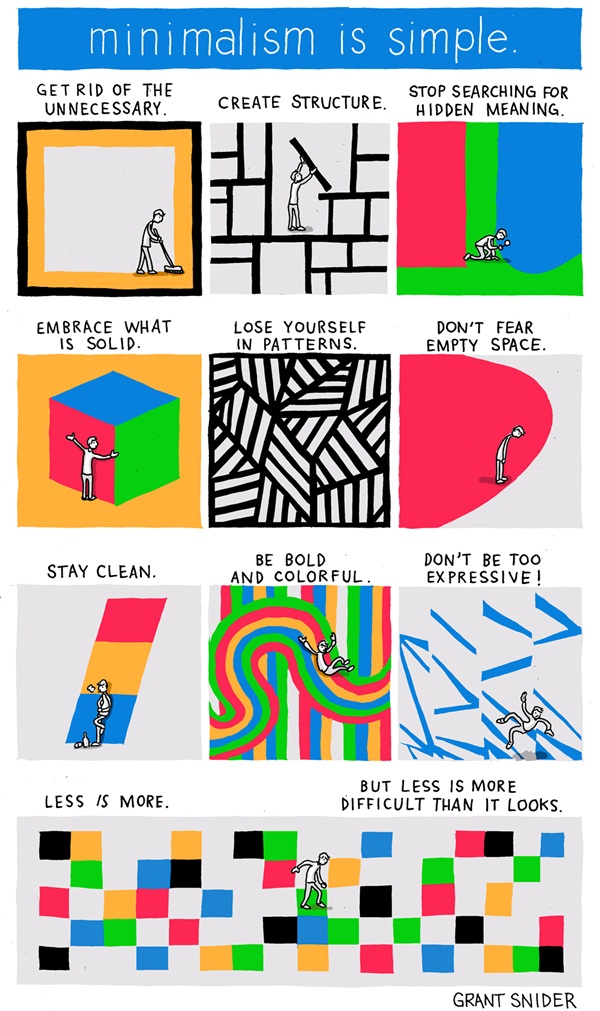

Minimalism

Grocery retail market from Romania has fared quite dynamic in 2012, formats which include stores that were open throughout the year, was especially supermarkets and discount stores.

Format winner in 2012 was supermarket, small stores (convenience stores) has exploded. Thus, Mega Image retailer, present in Romanian retail market with two formats: Mega Image and Shop & Go, opened in 2012 the largest number of stores: 88, ending the year with a total of 193 stores.

Mega Image, the Romanian banner of Belgian company Group Delhaize, is retailer with the largest number of stores in Romania.

Another performers are Profi, who opened in 2012 no less than 45 stores, reaching 149 units at the end of the 2012 and Carrefour Market and Carrefour Express, the two supermarket banners of french retailer Carrefour, who opened in 2012 37 units in total.

On discounter sector Lidl, the German discounter opened 26 stores in 2012 and the other discount retailer, Penny Market has opened 14 units.

No major changes occurred on hypermarket sector, as expected, the total opening was only 12 hypermarket stores: 10 Kaufland stores and one in his right Auchan, Carrefour and Cora. Next year will counting the 20 real stores to Auchan, purchased late last year by the french retailer.

Cash & Carry format has stabilized somehow in 2012, at least in terms of number of stores. No store opening for the two representatives of this format: Metro and Selgros.

La grande distribution en 2012 subit les conséquences de l’impact de la baisse de la croissance et celle du moral des ménages. Malgré une augmentation de 2% en valeur en 2012, le secteur reste à la traine par rapport à ses performances de 2011. La progression de l’e-commerce, les bénéfices des discounters ou encore le ralentissent des ventes de biens d’équipements, Cedric Bra, analyste distribution au sein d’Euromonitor International, explique qui sont les gagnants et les perdants de l’année 2012.

Over the weekend, we have decided to work on some more logo options for the brand name of my daughter: “La P’tite Parfumerie” including the very 1st design (No. 1).

We will go together slowly thru them maybe tonight and meanwhile feel free to vote for your favorite logo, it might help us decide.

If we don’t reach any final decision with this set, we might run a 3rd round of new logos.

To be continued …

For those who missed the Part 1 of this series, you can start reading here.

So after a small brainstorming session, my daughter wrote down few names she had in mind for her future business, the perfumes store.

We went together thru the list and ended up picking: La P’tite Parfumerie, sorry for her being Frenchy, she is French educated in a Francophone country :-)

Dad, can you make a logo for the name?

Sure sweetheart, just give me 1-2 days.

After showing her the below logo, she goes, hmmm, it’s nice “but” can you make some other options so I can choose from.

Great, she is on the right track!

To be continued …

Below is a list of the books I am planning to read in 2013 in no specific order.

1) Amazing Things Will Happen: A Real-World Guide on Achieving Success and Happiness

2) The Startup Owner’s Manual – The Step-By-Step Guide for Building a Great Company

3) Strategic Retail Management: Text and International Cases

4) Brand Against the Machine – How to Build Your Brand

5) Made to Stick – Why Some Ideas Survive and Others Die

6) People Buy You – The Real Secret to what Matters Most in Business

7) The Business of Venture Capital – Insights from Leading Practitioners

8) What the Customer Wants You to Know – How Everybody Needs to Think Differently About Sales

9) The End of Work as You Know It

10) The Power of Habit – Why We Do What We Do in Life and Business

11) The Art of Non-Conformity – Set Your Own Rules

12) Flying Without a Net – Turn Fear of Change into Fuel for Success

<img src="http://krikor.info/wp-content/uploads/2013/01/books2013.png" alt="books2013" width="600" height="725" class="alignleft size-full wp-image-8695" /

According to estimations included in the PMR report entitled “Private label in Poland 2012. Market analysis and development forecasts for 2012-2014”, the value of the private label market increased by 18%, thus reaching almost PLN 29bn (€7bn) in 2011.

According to estimations included in the PMR report entitled “Private label in Poland 2012. Market analysis and development forecasts for 2012-2014”, the value of the private label market increased by 18%, thus reaching almost PLN 29bn (€7bn) in 2011.

The high growth rate of the market in 2011 was the result of a significant sales value growth in supermarkets and discount stores, which reached 20% in both channels. As a result, both these formats expanded their market share. Hypermarket sales also developed intensively last year, although at a lower rate than the year before (18%). Traditional trade increased at a rate much below the market level.

Source: Poland Forum on Linked

My comment:

” When i look at the growth curve on the document, i believe and IMO after 2009 and 2010 the major retail players in Poland noticed and started being aware that if they don’t handle the private label products properly, it will hurt their business instead of growing it and here i am not talking about the Hard-Discounters who on a separate note started introducing national brands in their assortments in Germany and France lately.

Poland is and will become more and more a very attractive place for supermarket retailers in all format, and i always wondered why this country and its consumers are so receptive in this industry.

Major retailers are squeezing their assortments and throwing out more and more SKUs with slow rotation to replace them and give more chance and shelf space to their private labels in the same category with higher margins and faster rotation, no matter what was the cost of introducing that branded product on the shelf initially, when the buyer is squeezed for margins by his management, he is squeezing the suppliers and i had to go thru this with 2 retailers in Poland, Carrefour and REAL. I also feel that Carrefour is becoming a Soft-Discounter and trying to compete as being the “every day low price” store.

Another game the retailers are now playing are the private label brands themselves, lately the retailers tried also to skip showing their store brand name on the packages and started developing their “own but not store brand” different names as they are aware some consumers/customers are very sensitive to this issue.

One more game played by the biggest hard discounter in Poland, Biedronka, who in my opinion is taking the hard discount industry by storm in Poland and giving hard time to Lidl, Aldi, Netto and all the rest, is to introduce a product under any given brand, not necessarily a known brand and test it in its stores, if things start rolling in 3-6-12 months (depending on the product category) then the supplier should start switching his brand to Biedronka’s brand and keep on supplying.

I negotiated for more than 1 year and it is quite tough to list 1 single product in 1600 stores (Biedronka stores number at that time)So yes, i totally agree that private label in Poland still has plenty of room to grow and only few major brands will survive this odyssey! “

You can also read: How smart are Polish shoppers?