No matter what consumer-driven industry you’re in, the latest developments in retail and shopping need to be on your radar. After all, retail is about that very crucial moment that consumers actually PURCHASE your goods and services in person. If that isn’t worth half an hour of your time, we don’t know what is ;-)

While traditional retail is facing serious and sometimes deserved challenges (Bland chains! E-commerce! Environmental impact! The financial crisis! Demographics! Anti-consumerism!), most people do, and will continue to, enjoy going shopping in the real world. From Oxford Street to Nanjing Road. In fact, rather than witnessing RETAIL RUIN, a RETAIL RENAISSANCE is in the making:

RETAIL RENAISSANCE | Smart retailers are defying doom and gloom scenarios, as they realize that shopping in the real world will forever satisfy consumers’ deep rooted needs for human contact, for instant gratification, for the promise of (shared) experiences, for telling stories. Hence the flurry of new formats, technologies, capabilities, and products that now are delighting retail customers around the world.

Here are just four drivers behind RETAIL RENAISSANCE (there are many more, but we think you’ll get the point):

- OFF=ON: How the benefits of shopping online can now be had offline by consumers too.

- RETAIL SAFARI: How experiences still rule.

- INSTANT STATUS FIX: How shopping in the real world delivers instant status gratification in a way that online (still) can’t.

- CITYSUMERS: The future of consumerism is urban, and urban culture is retail culture. On a global level.

1. OFF=ON

Way back in 2008, we published a Trend Briefing on OFF=ON, highlighting the new ways in which the offline world was adjusting to, if not mirroring the increasingly dominant online world. We stated: “where OFF=ON gets most interesting [is that] a whole new set of business practices and processes, not to mention client involvement and marketing techniques, have emerged online, with consumers relishing these developments, and thus the offline world has to adapt.”

Since then it’s actually been more about total immersion than adaptation: the online world is now completely accessible even when ‘offline’ (that is, away from any kind of online device that is too clunky to be used on the go). For consumers, this is a cause for celebration: because while they want (if not crave) to be online 24/7 (ONLINE OXYGEN), they still prefer to live in the world of warm bodies rather than cyberspace (please re-read MASS MINGLING).

For retailers, this means a world where not only have consumer expectations been set by a decade of shopping online, but one where consumers can access all the things they love about e-commerce – convenience, the ability to hear other consumers’ experiences, total price transparency, and virtually endless choice – out in the ‘real world’ too.

Just check out this recent anecdote, about a shopper in Sears, who when faced with an in-store price $3 higher than Sears’ online store, simply pulled out his smartphone, bought online, selected in-store pickup and walked over to collect his purchase (via The Consumerist).

Extreme? Perhaps, but consider this selection of stats:

- 8 out of 10 consumers research purchases online. While 42% research online and then buy online, 51% research online and then buy in-store (Source: Google & IPSOS OTX, September 2010).

- Multi-channel consumers who receive information from more than one source (store, online, mobile, or catalogue) prior to purchase, spend 82% more per transaction than a customer who only shops in store (Source: Deloitte, December 2010).

- E-commerce conversion rates have been hovering around 2-3.5% while brick-and-mortar conversion rates for fashion retailers have been around 20-25% (Source: Verdict Research, May 2010).

- Of the 40% of US consumers who own smartphones, 70% use their smartphones while shopping in-store (Source: Google & IPSOS OTX, April 2011).

- 74% of smartphone shoppers made a purchase as a result of using their smartphone. Of these 76% have purchased in-store, 59% online while only 35% have made a purchase via their smartphone (Source: Google & IPSOS OTX, April 2011).

- Mobile barcode scanning (including traditional UPC barcodes and QR codes) increased 1,600% globally during 2010 (Source: Scanlife, December 2010).

But OFF=ON is a cause for celebration for retailers too: not only do consumers still enjoy the real world (more on that in RETAIL SAFARI below), but (for now) online benefits are moving ‘offline’ far quicker and more successfully than efforts to replicate the real world, online (Second Life stores anyone!?).

No wonder then that smart retailers are increasingly catering to consumers’ INFOLUST, mimicking if not actually bringing the online experience to their in-store shoppers: everything from in-store price comparisons and customer reviews to suggested pairings (shoppers who bought this also bought…).

Doing this will increase sales and improve customer satisfaction by reassuring shoppers that they are purchasing the best of the best, at the cheapest possible price: obviously required information in today’s EXPECTATION ECONOMY. Add to this everything from e-coupons to buy-online / pick-up offline services, and the real world’s enduring advantages will actually receive additional desirability because of online developments.*

*Yes, consumers will continue to be in love with e-commerce too, of course:

This Trend Briefing looks mainly at physical retail. Now, while the distinction between ‘online’ and ‘offline’ is becoming increasingly meaningless, in no way are we suggesting that e-commerce won’t continue to grow rapidly (because it will), or that online retailers won’t continue to come up with innovations that transform the online shopping experience (because they are).

So, watch out for our full Trend Briefing on e-commerce coming soon, or re-read our Trend Briefing on THE F-FACTOR for some insights into the new ways in which consumers’ purchases are influenced by their online friends, fans and followers.

2. RETAIL SAFARI

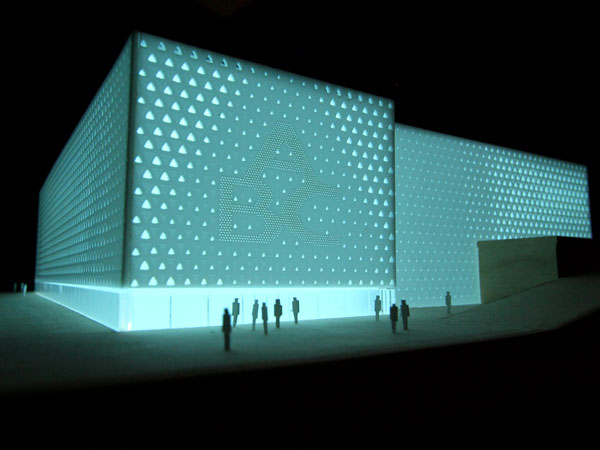

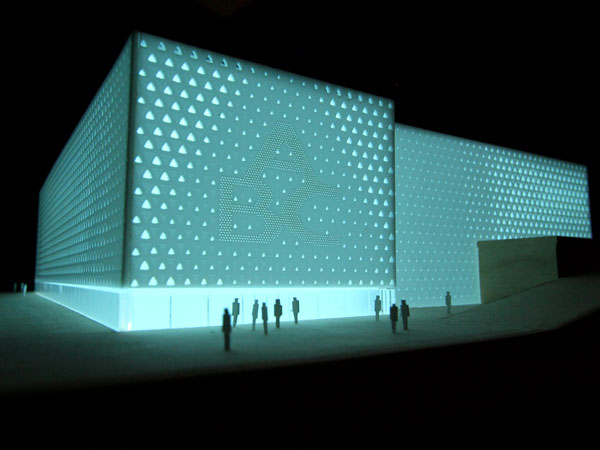

A window display on Nanjing Road, Shanghai

Shopping moments are now ubiquitous: offline (in the real world, nearly everything now has a retail component!) and online. Meaning that over the last years, smart retailers have looked hard at what would make them unique and forever desirable.

The ones who have been relentlessly reinventing themselves understood that while ON=OFF brings extra transparency and information into stores, shopping isn’t purely functional. For a large number of consumers around the world, ‘going shopping’ is a leisure activity: a way of relaxing, a source of entertainment or a chance to meet up with friends and share experiences.

Indeed, when consumers go shopping in person, they increasingly expect to feel or experience something that they can’t get online: a compelling spectacle, exclusive products, the ability to test and feel things, or learning how to use products. Hence, the rise in highly experiential stores and outlets, turning the retail arena around the world into a veritable RETAIL SAFARI.*

* We’re not saying that physical stores will become wholly focused on providing ever more extreme experiences. It’s a cliché, but there will always be shoppers who just want the convenience and instant gratification of buying in a physical store. In those cases too, retailers who make that process so enjoyable or personal that consumers don’t feel the need to compare it online will thrive. Just look at Apple!

3. INSTANT STATUS FIX

Whether it’s the sensory impact of walking around a store, flaunting the bags, being served by caring shop personnel or just purchasing items in an environment with other people looking on, a shopping experience in the real world delivers instant status gratification in a way that online (still) can’t. However shallow that might be ;-)

Regular readers will be familiar with the idea that the search for social status underpins much of consumer behavior (do re-read our Trend Briefing on STATUSPHERE), and thus, the act of real world shopping will remain a popular way for consumers to receive their status fix.

4. CITYSUMERS

From the ‘old’ world to the ‘new’ world, everyone (still) loves to shop, shop, shop!

We couldn’t let this Trend Briefing pass without looking at unrelenting urbanization and the expansion of consumer culture it brings.

As we said in our recent Trend Briefing on CITYSUMERS – cities are retail nirvanas: urban culture is retail culture. Urban dwellers have more disposable income, more leisure time and virtually limitless opportunities to spend it, and as a result, retail therapy will remain a key prescription for CITYSUMERS.*

While this is obviously true in mature markets (that are already urban), the real story is in emerging markets, where urban migration unleashes tens of thousands of new, eager consumers into the retail arena every day (if this upsets you, please don’t shoot the messenger! ;-).

Just a few stats:

- Chinese retail sales in July 2011 rose 17.2% to CNY 1.4 trillion (approx. USD 222 billion) from a year earlier. Urban retail sales increased 17.3% year-on-year to CNY 1.25 trillion, while rural retail sales climbed 16.4% to only CNY 191.9 billion (Source: National Bureau of Statistics, August 2011).

- Between 2001 and 2010, retail sales in developing markets went from 35% of the global total to 42%, with per capita growth of nearly 100%, from USD 2,009 to USD 3,847 (Source: AT Kearney, June 2011).

- Asian retail sales are forecast to grow from USD 5.4 trillion in 2010 to USD 8.5 trillion in 2014. Retail sales in North America and Western Europe at that time are forecast to be USD 4.5 trillion and USD 2.7 trillion respectively (Source: PWC & Economist Intelligence Unit, January 2011).

* Certainly not all consumers adhere to the philosophy that ‘more=better’. From eco-concerns to unconsumption movements, sources of social status are increasingly fragmented for mature consumers, and now include ‘new’ status symbols such as generosity, skills, connectedness or reputation (see our STATUSPHERE Trend Briefing for more on this). But, whatever a consumer’s definition of status, in modern, connected, urban environments, there will forever be opportunities (temptations even) to satisfy it through consumption.

EXAMPLES

Time for an avalanche of OFF=ON, RETAIL SAFARI, INSTANT STATUS FIX and CITYSUMERS innovations from retailers who already ‘get it’:

1. BRINGING THE BEST OF ONLINE TO THE REAL WORLD

- In February 2011, JC Penney, the US department store, rolled out its findmore service to 120 stores across the US. In-store, 42 inch touch screens allow shoppers to view the retailer’s full online catalog, check inventory levels in local stores, share products with friends and scan product bar codes to receive extra information and complementary product recommendations.

- In August 2011, Westfield, the world’s largest shopping center operator, added Google Commerce search functionality to its in-mall mobile app to save shoppers’ time in their malls. Shoppers can search and compare prices across retailers in their local Westfield shopping mall, and call the local retailers to check availability with one click.

- Canon and Clairol’s Herbal Essences have both added Microsoft Tag technology to their in-store products, allowing consumers to easily access customer reviews.

- The Financial Times reported in July 2011 that Tesco, the UK based supermarket was piloting free in-store wifi, allowing customers to check prices online and read product reviews. Nordstrom, Sam’s Club and Home Depot in the US already offer similar services in many stores.

- In August 2011, the New York Times reported on an increase in the popularity of digital, paperless receipts. Retailers in the US including Whole Foods Market, Gap Inc., Sears and Kmart offer shoppers the option of choosing to receive proof of purchase by email or via password-protected websites.

- In April 2011, Google introduced Local Product Availability. The feature allows customers to see which products are in stock at participating local retailers.

- Singapore-based mobile operator SingTel launched their flagship store in Singapore’s Comcentre in July 2011. The store’s exterior glass walls have embedded interactive digital touchscreens in them, meaning that the store is effectively open 24/7.

- Retailers are also trying to tap into THE F-FACTOR. Tasti D-Lite, a US frozen yogurt chain launched its BeSocial program, linking in-store tills to social networks. Customers can select from a number of preset messages and swipe their loyalty card to post about their purchase and gain additional points.

2. BE EVERYWHERE: OFFLINE AND ONLINE

- Luisa Via Roma, a luxury boutique based in Florence, Italy, has a great understanding of how to use different mediums and platforms successfully, engaging customers around the world in a way that enhances the cachet of the bricks-and-mortar store. With their recently launched ‘3D virtual store’, online shoppers can browse a mock up of the real, physical store.

- In February 2011 during London Fashion Week, UK based fashion house Burberry streamed their fashion show live in all of their stores around the globe, as well as on the iconic Coca-Cola billboard in Piccadilly Circus.

Of course, it’s not just physical retailers that are exploring new sales channels: e-commerce brands too need to reach out to consumers everywhere, real world included. Learn from:

- Home plus, the Korean branch of Tesco, recently launched a series of virtual stores on subway platforms, enabling customers to make purchases using their smartphones while they wait for a train. During the campaign, Home plus online sales increased by 130%, with over 10,000 customers trying the stores.

- Shazam, a service that allows users to ‘tag’ a song, is being sponsored by eBay until January 2012. Users of the mobile app ‘shazam’ songs that they hear playing, to receive details about the song and artist, along with an option to buy. eBay’s involvement is part of the online retailer’s efforts to be at the front of consumers’ minds, not just when they are traditionally planning to buy something, but at any moment they are thinking about, querying or discussing anything, anywhere.

3. TAILORED IN-STORE INFORMATION

- In January 2011, Kraft and Intel partnered to launch The Next Generation Meal Planning Solution, a kiosk that provide users with customized recipes and offers to help them plan meals, with directions to relevant in-store products.

4. BUY ONLINE, PICK UP OFFLINE

- In March 2011, Walmart launched Pick Up Today, a service that allows customers to order online and collect their shopping from a local store the same day.

- French supermarket Chronodrive has a designated pick-up depot for consumers to pick up products ordered online.

- Shoppers at Real can take advantage of the German retailer’s click-and-collect service, Drive; after purchasing online, consumers can collect their groceries at a pre-arranged time directly from the store, as quickly as two hours after ordering.

- US lifestyle store Bed, Bath & Beyond takes in-store pickup one step further with their ‘Shop Your Local Store & Pick Up Near Your School’ service. The program enables students to stock up on dorm room essentials such as bedding, towels and decorations at any store, and have them delivered to a branch near their college for pick-up, thus avoiding shipping costs and making moving to college easier.

5. PRICING PANDEMONIUM

We identified PRICING PANDEMONIUM as one of the key trends for 2011, and retailers have certainly not been holding back. Some recent spottings:

- In March 2011, US retailer Gap launched a one-off deals site, gapmyprice.com, where shoppers could decide how much they wanted to pay for their khakis and make an offer online. The retailer then put forward its price, which consumers could accept or make a further bid until a final price was agreed on. Successful bidders collected their pair from a local store.

- In February 2011, Old Navy partnered with music recognition app Shazam to launch a series of interactive TV ads. Users who triggered the app during the commercials were directed to a mobile site with coupons and tips. The first 1,000 people also received a voucher to collect a free pair of jeans from stores.

- In July 2011 Groupon partnered with supermarket chain Jewel-Osco and Unilever to offer USD 15 worth of Ben & Jerry’s ice cream products for USD 9. Shoppers paid up front, with the deal loaded onto their loyalty card for redemption in-store at the checkout.

6. REWARDING VISITS

With shoppers permanently online (see ON=OFF), there are endless new and very effective ways for retailers to attract people to stores. Here are just a handful of the many recent examples:

- In July 2011, American Express launched two social commerce initiatives for both consumers and businesses: Link-Like-Love, an app that gives users personalized discounts based on Facebook Likes and check-ins, and Go Social a tool that enables retailers to offer customers offers integrated with Foursquare and Facebook.

- Shopkick, is a location-based gaming app that dispenses “kickbuck” reward points to consumers for checking-in to stores, via sensors that automatically recognize when shoppers enter the store. Retailers such as Macy’s and Best Buy signed up in 2010, and in June 2011 the company announced that they were extending the program to 1,000 smaller, local stores in a partnership with Citi.

- 7-Eleven have partnered with Paramount and Foursquare in a campaign that encourages users to check-in to stores to win prizes. Every 88th person to check-in wins a free movie ticket, every 88,888th person to check-in wins a ticket for a zero gravity experience, while the 888,888th person to check-in will win the grand prize of a sub-orbital space trip.

7. HYPERLOCAL DEALS

There appear to be endless mobile deal apps, now two of the biggest carriers have recently launched their own hyperlocal deal services. Two to watch:

- March 2011 saw US based AT&T pilot ShopAlerts; an opt-in service that sent location-based offers to the telecommunications provider’s customers.

- Launched in the UK in July 2011, telecommunications operator O2’s Priority Moments service enables the network’s customers to access exclusive offers and deals based on their location. The PERKONOMICS-inspired service is free for customers who download an app, and deals include free gifts with purchases and discounts.

- ThinkNear takes into account businesses’ slow periods as well as monitoring local events and conditions for factors that could reduce foot traffic, such as rain and snow. It then generates deals that are sent to nearby consumers as online coupons. The service launched to restaurants, spas and salons in New York in July 2011, and is expected to expand to other retailers in the future.

- Launched in August 2011, QuickerFeet is an Australian-developed iPhone application that allows retailers to alert potential customers to promotions taking place in their vicinity. Retailers design their own promotions at times of their choosing, and QuickerFeet charges a flat fee per promotion rather than commission on sales.

8. MORE THAN A STORE

- US drugstore Duane Reade opened a flagship store on Wall Street in July 2011. As well as a pharmacy and onsite doctor, the store contains hair and nail salons, virtual makeover kiosks, secure cell phone charging stations for customers while they shop, and a shoe shine service (the latter’s proceeds going to charity).

- Japanese beauty retailer Shiseido launched its flagship in Ginza, Tokyo in May 2011. The three-storey store offers virtual make-up simulator kiosks, which allow customers to try many different products without actually putting them on, while the upper floors are devoted to experiencing the products, with a photo studio, luxury consultation and treatment suites.

- Italian lingerie retailer Angelique Devil offers a number of experiences, including ‘Sensual Fashion Set’. Customers receive a consultation with a make-up artist and stylist, before a photo-shoot with a professional fashion photographer. After the session, a private screening is held and the customer receives a DVD and five printed photos.

- In Seattle, gift store Curtsy Bella’s free personal shopping service operates via phone or email, allowing busy customers to save time when choosing a gift. Shoppers simply place their request with one of the retailer’s staff, giving details about the gift’s recipient and their budget for the item, and then Curtsy Bella will email a selection of ideas with images and price points. Once the shopper has come to a decision, the store takes care of gift-wrapping and delivery.

- Or, for a slightly more light-hearted initiative, check out Isla Azul, a shopping center in Madrid that launched a great BRAND BUTLER service, offering customers a free full-board ‘hotel service’ for their houseplants, providing love and attention while owners are on vacation.

9. ALL OF THE WORLD’S A SHOP

Retail is everywhere. Check out these combinations of shops and only-in-the-real-world activities:

- Spanish publisher ES Ediciones, launched La Pizzateca in Madrid in December 2010. The pizzeria-cum-bookstore offers a “menú de las letras” — which includes a slice of pizza and a book for just EUR 5.

- In Rome, the Zoc and Urbana 47 restaurants serve up food based on fresh, local produce with an emphasis on sustainability and traceability. Both are furnished with an eclectic selection of modern and vintage tables, chairs and decorations, all of which can be purchased by customers.

- Cook & Book is a retail space dedicated to books and food in central Brussels. The concept store in divided into nine themed areas, each with a distinctive decorative style and dining space; visitors can savor tea and scones in the English room, or enjoy a glass of wine while perusing books in the Art or Music rooms. There is also an area for children, and regular special events, such as the outdoor cinema program that took place in July 2011.

- Launched in May 2011, Los Angeles based store Books and Cookies is an educative environment providing children with literature and tasty treats. The store stocks children’s books – available to purchase or read in the child-friendly reading room area – toys, and freshly baked cookies and snacks.

- Radar Hair and Records in Seattle offers hairstyling services in addition to a selection of vintage clothes, accessories and vinyl, meaning that consumers can browse the store while they enjoy a cut or color. The store-salon also hosts evening events, such as concerts, art exhibitions and fashion shows.

- Dutch 2theloo is a chain of ‘always clean’ restroom shops in city centers, shopping centers, and train and gas stations, that offer not only eco-friendly toilets (including disabled access restrooms and family restrooms) but also shops with toiletry products and even “sometimes a coffee corner”.

- From January to March 2011, Shanghai’s Museum of Contemporary Art hosted ‘CULTURE CHANEL’, celebrating five themes underpinning the Chanel philosophy: Origin, Abstraction, Invisibility, Liberty and Imaginary.

- From April to July 2011, Moscow’s Pushkin State Museum of Fine Arts’ ‘Inspiration Dior’ set Dior’s work against modern art and society.

- The National Museum of China reopened in May 2011 with Louis Vuitton’s Voyages exhibition, marking the 20th anniversary of the retailer’s presence in China.

10. TRYVERTISING

Ever since we coined the phrase ‘TRYVERTISING’ back in 2005, we’ve seen plenty of examples of stores where customers can try out new products. Here’s the latest one:

- Sample Central, a Japanese tryvertising store announced in July 2011 they would be opening a second outlet in Budapest, Hungary. The store operates a membership policy, where members can trial new products, in-store or at home, in return for completing questionnaires about them.

11. PLEASE DO TOUCH THE MERCHANDISE

- Sony’s new concept store in Los Angeles’ Century City mall places the products on tables and encourages customers to experiment with them. Expert staff are on hand to answer any questions.

- The electrical retailer Dixons launched ‘Black’ in December 2010. The concept store aims to mimic fashion retailers, with product ‘collections’ that change with the seasons. The store also contains a KNOWHOW area where customers can learn tips and tricks.

- Gomus is a Brazil-based music branding company which provides a distinctive retail environment using sound. Gomus embeds RFID tags in clothing, and when a customer tries on items in the changing room, they are played a song chosen to match the feel or mood of the clothing. The project is being implemented in selected Brazilian clothing stores during 2011.

12. TRYING OUT FIRST

- Seeing that for many consumers, a trip to the fitting room involves too much commitment, Old Navy installed Quick Change booths in the middle of the store, enabling time-pressed consumers to quickly and conveniently try on single items.

- June 2011 saw mass-market fashion retailer Topshop launch their Personal Shopping Suite in the brand’s Oxford Circus flagship in London. With five personal shoppers catering to a range of styles, and complete with Xbox and bar areas, shoppers are positively encouraged to spend as long as possible using the free service.

- MyBestFit is a free service available in a number of US malls. Customers enter a whole-body scanner, before being advised which different brand sizes will fit them best.

- In January 2011, ng Connect, in partnership with French beauty brand L’Oreal and US retailer Bloomingdale’s, unveiled the ‘Virtual Personal Stylist’; a retail concept designed to make shopping easier for both consumers and brands. Shoppers visit an in-store 3D scanning booth in order to create an online avatar which can be accessed in participating retailers’ stores via an interactive mirror kiosk.

- The SnapShop Showroom app gives US shoppers the chance to try out furnishings from a variety of retailers in their own homes, using augmented reality. Users choose an item and then overlay the image into their interior using their devices’ camera. Consumers can snap photos and send them to social networks or via email if they want to share with friends. Links to buy the actual furnishings are included for easy, in-app purchasing.

- UK based luxury jewelers Garrard created a ‘try on a virtual tiara’ experience in its store window, as part of Vogue’s Street Lights initiative in May 2011. The GBP 100,000 diamond and spinel tiara sparkled and glittered as the subject moved their head.

13. IN-STORE CLASSES

Consumers don’t want to just buy, they want to do. A perfect opportunity therefore, for brands that can help customers acquire ever-valuable STATUS SKILLS:

- Cook and Coffee is a retail space in Paris set up and run by Italian electronic appliance manufacturer De’Longhi. Customers can learn the history of coffee from a specialist barista, sample various blends and try out kitchen appliances including espresso makers and food processors. The space is equipped with interactive screens and from September 2010 onwards, consumers could attend free of charge cooking workshops, such as how to make custard or pasta.

- Over a two-month period from June 2011, German domestic appliances manufacturer Miele hosted a number of cookery classes named Simply Cooking at Miele’s Abingdon Experiences Center and London Gallery in the UK.

- During the World Photography Festival 2011, Japan based electronics manufacturer Sony held four photography and videography workshops in April 2011, hosted by professional nature, sport and fashion photographers from around the world.

- Or for those who’ve done it all, Paxton Gate, a San Francisco based store stocking ‘treasures and oddities inspired by the garden and the natural sciences’ has started offering taxidermy classes to interested beginners. Students learn how to fit and sew a tanned hide, and make their very own small mammal piece during the six hour class. The course costs USD 350.

14. IN-STORE EXHIBITIONS

- In February 2011, Italian fashion house Dolce & Gabbana debuted its ‘Dress Me Up’ project at Milan Fashion Week. The event saw the brand invite a hand-picked selection of fashion bloggers to style its store’s window displays. Further events took place in London and Madrid during March and May 2011, all streamed live online.

- In Rome, during May 2011, Italian fashion brand Fendi debuted its ‘Fatto a Mano for the Future’; a live in-store project inviting artists and designers to collaborate with Fendi’s craftsmen to create sculptures or art works with materials discarded during the manufacturing process.

- Deutsche Telekom’s 4010 store in Cologne has a strong pop art theme, influenced by the city’s Ludwig museum, which has one of the largest pop art collections in the world. The store also acts as a gallery, with new works arriving every few months.

15. POP-UP 4.1

While we coined POP-UP RETAIL and POP-UP STORES about a century ago (in 2004, to be precise), we couldn’t possibly let a Trend Briefing on retail pass without this ever-popular sub-trend. In fact, even since our POP-UP 4.0 update just two months ago, we’ve spotted dozens of new examples. Here are just three of them:

- UNIQLO have installed a roller rink and pop-up shop (the UNIQLO Cube) under the High Line in New York from July to September 2011.

- Jay-Z’s Rocawear launched a pop-up in New York in June 2011. But the venue wasn’t a store, more a location for visitors to record testimonials, to be uploaded to the brand’s website.

- The fashion retailer H&M took a pop-up store to The Hague’s popular Scheveningen seaside resort to promote their collaboration with WaterAid, the global charity that campaigns for safe water in developing countries. Customers could buy items from a special blue range of beachwear, with 25% of proceeds going to the charity.

16. LIMITED LOCATIONS

Back in 2010 we noted that forgoing chain-wide rollouts or borderless e-commerce would appeal to consumers (Chinese tourists in Europe looking for that one-off bag, anyone?) wanting the excitement of having to physically go and buy something. LIMITED LOCATIONS – selling something in just one (geographical) location – will trigger enthusiasm, PR, status stories and premium prices. Even better if the product can tap into some URBAN PRIDE too:

- In April 2011, to celebrate the launch of its boutique on Via Condotti in Rome, Christian Dior re-issued a handful of its iconic French Lady Dior bags that could only be purchased from the store. Each bag contained a special label: ‘Christian Dior Paris – Made in Italy – Rome Limited Edition’.

- In May 2011, Gucci released limited edition tote bags in four different colors, each inspired by a corresponding city: aqua green for Capri, lavender for Cannes, orange for Marbella and red for Monte Carlo. The bags were only available from stores in these cities.

- In April 2011, Germany luxury brand MCM opened its first flagship store in Beijing. To mark the occasion MCM introduced the limited edition Beijing Mocha Luxe Exclusive Collection, which was only available in the Beijing boutique.

It’s not only luxury brands experimenting with LIMITED LOCATIONS though:

- Footwear brand Converse opened a store in New York’s SoHo district in November 2010 selling New York related graphic t-shirts that feature the city’s iconic boroughs and neighborhoods such as SoHo, Coney Island and Hell’s Kitchen.

- Also in November 2010, Levi’s released a limited edition of its 505 jeans – 505 pairs to be exact. Retailing for USD 178, the jeans supported the US denim industry as the denim is sourced from Cone Mills, one of the oldest denim mills in the world and one of the last existing in the US. Jeans were only available in Levi’s San Francisco flagship store and its Concept Store in New York City.

- Unknown Union, a menswear boutique that opened in April 2011 in Cape Town, stocks a range of local and international designers. Their in-house label however, is manufactured in Africa and available exclusively at the Cape Town store.

17. CO-BRANDED STORES

We’ve featured BRANDED BRANDS before: demanding consumers looking for the best of the best create an impetus for two brands to bring their unique competences to the table, in order to re-imagine or invent a new, unique product or service, combining the best from multiple worlds. Two recent retail examples:

- June 2011 saw Hello Kitty launch a range created in collaboration with Austrian crystal company Swarovski at the ‘House of Hello Kitty’ in Tokyo. The “Swarovski Hello Kitty Collection” included jewelry, accessories and home wares encrusted with Swarovski crystals. Visitors could use an AR photo booth, where they could virtually try on merchandise from the collections such as jewelry and hair accessories. There was also an auction to raise funds for the Japanese Red Cross earthquake relief charity. The limited edition range included a USD 100,000 clutch bag and 88 figurines priced at JPY 1.2 million (USD 14,800).

- Sephora, the French beauty retailer, announced in July 2011 that they were partnering with XpresSpa, the airport spa operator, to launch the Sephora Nail Studio, offering customers in New York and San Francisco in-store manicures using own-brand products.

18. TRIBETAILING

Catering to specific customers remains an old, if foolproof way to appeal to consumers:

- Opened in June 2011, Pánská Pasáž is an upscale mall in Prague focusing primarily on male shoppers. Pánská Pasáž – which translates roughly into ‘Gentlemen’s Arcade’ – is the first shopping centre in the Czech Republic dedicated primarily to men, its creators say. The 800-square-meter venue features 19 luxury shops including Ralph Lauren, famed Austrian tailor Knize, a gourmet food market, a shoe shop, a parfumerie for men, a traditional barbershop and a tobacco store.

- Japanese department store Keio tailors its retail space to enable elderly consumers to shop with ease; lower shelves, older staff, signage with large fonts and strategically-placed chairs are just some of the facilities that make the store extra welcoming to the more mature shopper. In a nod to the free time many retired consumers enjoy, the store’s loyalty card scheme functions based on the frequency of visits, rather than the value of purchases.

- In April 2011, JC Penney launched the first of 300 planned Foundry Big & Tall stores in Dallas. The stores, which are aimed at plus size men, are inspired by a microbrewery, with TVs showing sports and oversized poker tables.

19. STATUS STOR(I)ES

- Triple Major, the Beijing-based boutique concept store opened its third ‘nomad store’ in Los Angeles for two weeks in August 2011, disguised as a taco stand. The studio’s original store in Beijing resembles a typical Chinese medicine clinic, while the ‘nomad store’ it ran in Hong Kong for a week in November 2010, was set up to look like a traditional real estate agency.

- Bodega is a Boston sneaker store which is literally hidden from view. Located underneath a South American-style convenience store, in order to gain access shoppers need to find a Snapple vending machine on one of the walls and then enter via a trap door. Once inside the shop is decked in polished hardwood and offers a vast array of footwear.

- In May 2011, Disney opened their largest store in Europe on London’s Oxford Street. Each day, one child is chosen to conduct the ‘opening ceremony’, when Tinkerbell sprinkles fairy dust on the 8-meter-high in-store castle.

- Between May and August 2011, Kiehl’s, the skincare and beauty retailer, is celebrating its 160th anniversary by allowing customers to be photographed on a motorcycle owned by Steve McQueen.

- The People’s Supermarket is a UK store ‘owned’ by its members. Volunteers commit to work for a certain number of hours every month, in return for lower prices.

- Brothers Lane, in Austin, Texas, is gearing up to launch in.gredients — the first package-free, zero-waste grocery store in the United States. Shoppers at the store will bring their own reusable containers to fill with local and organic groceries ranging from dry bulk and dairy, to wine and household cleaners.

NEXT & MORE

August 2011: Queues outside Apple’s latest store opening, at the I Gigli mall in Florence, Italy

We’ve struggled to stop this Trend Briefing becoming a book, and yet we’ve only scratched the surface of what’s happening in retail.

So yes, we had to skip mass customization, smaller store formats, hip hotel stores, eco-stores, changing demographics, the artisan movement, celebrity curation, installation-art-concept stores, 5 star malls, stores within stores, ubiquitous vending machines, rent-a-box stores, downtown versus out-of-town, members-only stores, augmented reality fitting rooms and more.

Yet even the limited selection for this Trend Briefing shows that RETAIL RENAISSANCE will have many winners: retailers who embrace shoppers going online, in-store; retailers that can continually deliver compelling experiences, retailers that embrace urban consumer culture as it evolves around the world, and so on.

So keep watching, learning and (dare we say it) mimicking and outdoing those retailers contributing to RETAIL RENAISSANCE.

Source: www.trendwatching.com. One of the world’s leading trend firms, trendwatching.com sends out its free, monthly Trend Briefings to more than 160,000 subscribers worldwide.

![]() Coop, the Swiss retailer, has announced that it is withdrawing 35 new products by Procter & Gamble from its shelves. Coop the second biggest retailer in Switzerland, was unable to agree a price decrease with the US multinational for the products. P&G refused to lower its prices and rising commodity prices in recent months was the reason given to the Basel group for the decision.

Coop, the Swiss retailer, has announced that it is withdrawing 35 new products by Procter & Gamble from its shelves. Coop the second biggest retailer in Switzerland, was unable to agree a price decrease with the US multinational for the products. P&G refused to lower its prices and rising commodity prices in recent months was the reason given to the Basel group for the decision.